Supply Bonds

What Are Supply Bonds?

Supply Bonds are a three-party guarantee between a Supplier (Principal), Obligee (Owner or Contractor Receiving the Bond) and the Surety (Bond Company). The bond guarantees that material, equipment or other supplies mandated in the contract will be supplied according to the contract. If the bonded materials cannot be provided, a claim can be made on the supply bond. A Supply Bond does not cover labor which is an important distinction from other construction surety bonds.

When Are Supply Bonds Used?

Supply bonds are frequently required when providing products to the Federal Government. The Miller Act requires surety bonds on all contracts over $150,000. Additionally, Owners and Contractors may ask for supply bonds when a specialty item is specified in a project or when they fear price escalations. For example, if the cost of steel is supposed to increase significantly, they may ask for a supply bond to guarantee that the steel will be provided at the specified price.

Underwriting Supply Bonds

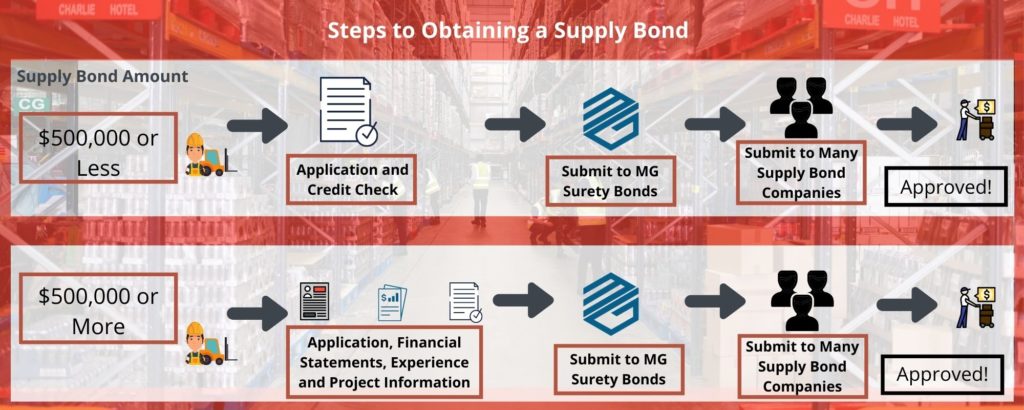

In most cases, supply bonds are very easy to obtain as surety bond companies view them as less risky than other types of contract surety bonds. This is the case for most standard materials and equipment that are easily obtainable. The thinking is that if the surety bond company must find another supplier of a common item, they could do so at a reasonably similar price. There are exceptions, however. Unique items with limited manufacturers or distributors present more challenges. For most contractors however, the surety bond company will want to review the following underwriting items:

• The contract including the price and items to be supplied

• Current and previous Corporate financial statements

• A personal financial statement on any owner with 15% or more of the stock

• A bank line of credit if one is available

• An application with the supplier’s experience

In many cases, small supply contracts under $500,000 can be bonded with only a credit application.

What is the Cost of a Supply Bond?

Like most contract surety bonds, the cost of a supply bond will vary based on the financial strength of the supplier, the contract and the material or equipment being supplied. However, in general, supply bonds are significantly cheaper than performance bonds and payment bonds. In many cases this cost is 0.5% or less but can go up to 3% for extremely unique items or those with credit challenges. MG Surety Bonds has access to the major surety bonds markets to get you the best rate for your circumstances.

Indemnity Required

Surety bonds are written on the principal of indemnity. This means that if the surety bond company suffers a loss, they will seek reimbursement from the indemnitors. Before getting a supply bond, the company and often the owners will be asked to sign a General Indemnity Agreement. You should read this agreement carefully before signing itl It spells out the terms and conditions of all indemnitors, along with the surety bond company. This is one major difference between surety bonds and insurance. Suppliers can read more about indemnity here.

Surety Bond Experts

We are a company that supports our customers by providing them with the surety bonds they need to thrive. We are not just internet marketers or insurance agents. We are surety bond experts. Our team has over 100 years of combined experience and has access to all major bond companies.

We Support Our Customers

Through creativity, experience and a commitment to the industry, we find a way to say YES and support our customers through bond placement, education and financial advice. MG Surety Bonds is affiliated with The Miller Group. The Miller Group is 60-year-old company that started with a focus on bonding contractors. Our people are dedicated to supporting our customers and giving back to the communities we serve. The Miller Group is committed to placing God, family and community first. We look forward to serving you.

About Us

MG Surety Bonds is an affiliate of The Miller Group. The Miller Group is a family-owned business headquartered in Kansas City with offices in Denver, CO and Dallas, TX. Founded by Bob Miller in 1961, The Miller Group is one of the largest insurance agencies in the region. Our mission is to protect and strengthen the assets of our business partners and their families.

Your Surety Partner for Life

Our team of dedicated surety bond professionals are the reason for MG Surety Bonds great success. The team’s only role is to consult, support and serve our bond customers. We work with large national accounts and accounts that need their first bond. We hope to have the opportunity to support you and your team. We want to be your surety partner for life!

We Want to Be Your Construction Bond Partner For Life

Experience Our Easy, Pain-Free Purchase Process

Buy a Bond