Like many states, Oregon requires contractors to be licensed and to post a valid Oregon Contractor’s License Bond in order to work in the state. The state deems that anyone doing work for compensation will need a license and a license bond. The license bond is meant to protect property owners by ensuring that contractors will comply with state requirements and perform their obligations. Property owners can file a complaint to the Oregon Construction Contractors Board (OCCB) if a contractor fails to keep these requirements. Should the OCCB rule against the contractor, they must pay the damages or the OCCB can file a claim against their license bond. It is important for contractors to keep in mind that if the surety bond company pays a claim against the license bond, they will seek reimbursement from the contractor. This is known as indemnity.

Amount of Oregon Contractor License Bonds Required

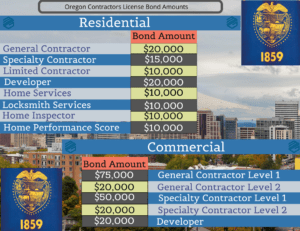

The bond amount for an Oregon Contractors License Bond depends on whether the contractor is performing commercial or residential work and what type of work is being performed. There are different license bond amounts for General Contractors, Specialty Contractors, Limited Contractors, Developers, Locksmiths, Home Performance Score, Home Services, and Home Inspectors. The chart below lists the license bond amount required for each type.

It’s also important to note that if a contractor is doing both commercial and residential construction, they will need a separate Contractor License Bond for each.

Underwriting Oregon Contractor License Bonds

Like most license bonds, Oregon Contractor License Bonds are easily obtainable. Most contractors can qualify based on person credit alone. Be prepared to provide the following:

- Full Name of the Company

- Address of Company

- EIN

- Amount of time the company has been in business

- Names of all owners

- Ownership Percentages

- Address of Owners

- Social Security Number of owners (to run credit)

- License Number if you have one

With acceptable credit, we can issue the license bond within minutes. Contractors with less than perfect credit can also qualify. They may be asked for additional information such as business and personal financial statements or they may just have to pay a higher rate.

Cost of Oregon Contractor License Bonds

The price of the license bond depends on several factors including credit and the time the contractor or company has been in business. Contractors who are willing to provide financial statements can qualify for even better rates. Most Oregon Contractor License Bond rates fall with 1-2% of the license bond amount. Because these license bonds are needed as long as the contractor is licensed and performing work, the bond premium will be due annually. Contractors can get significant discounts by purchasing multiple years upfront. These discounts can be anywhere from 20-40%.

Other Requirements:

Oregon has some state-specific rules on its Contractor License Bonds. Unlike some other states, they want the original license bond and not a copy. This original license bond must be included with the contractor’s application. They also require the license bonds to be received by them within 60 days of being signed by the Attorney in Fact. The license bond is not considered valid until it is put into effect by the Construction Contractors Board. Finally, Oregon has state-specific Contractor License Bond forms and they will not accept a license bond on a surety bond company’s own bond form. You can see a copy of the required license bond forms below:

Contractors and or consumers can check for valid licenses here. If a contractor is not already licensed in Oregon, there are eight basic steps to complete.

- Decide what endorsement you will need. There are a number of endorsements for both residential and commercial work that can be found here. Contractors will need to decide what work they want to perform and be qualified for.

- Select a Responsible Managing Individual for the firm. Each Company must have one and this person is responsible for doing the pre-licensing work and passing the test.

- Set up your LLC, Corporation, Sole Proprietorship, etc and file a business name.

- Get your Oregon Contractor License Bond discussed above.

- Get proper insurance coverage including workers compensation and general liability. The amounts required vary depending on your selected endorsement

- Set up state and federal tax identification numbers.

- Complete an application

- Submit the application, a certificate of insurance and your Contractor License Bond to the Oregon Construction Contractors License Board along with the $250 license fee.

Other Construction Bonds May be Required

Keep in mind that an Oregon Contractors License Bond only allows a contractor to be licensed and operate in the state. Other construction bonds may be needed such as bid bonds, performance bonds and payment bonds. These bonds guarantee different obligations and have different costs and underwriting requirements. Contractors should reach out to us if they have questions or a need for these surety bonds. You can also view our case study here.

Verify the Contractor License Bond

All contractors and consumers should verify that the contractor license bond they are getting is valid. There are some fraudulent surety bonds out there and it is important to make sure you get the protection you need. You can read more about verifying surety bonds here.

Whether you need your first surety bond to get your license, or you are an established contractor looking for better advice, rates and terms, we want to help you. At MG Surety Bonds, we are surety bond experts, not just insurance agents or internet marketers. We will work hard to make it easy for you and make sure you are a client for life. Click here for a fast quote on your Oregon Contractors License Bond.