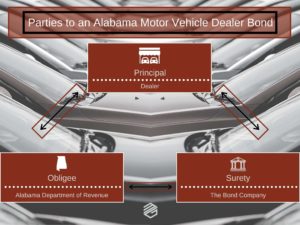

Auto Dealers in Alabama must file a Motor Vehicle Dealer and Designated Agent Bond with the state to obtain and keep a valid license. Alabama continues to grow in the auto industry. In fact, three of the top ten American made vehicles come from Alabama, so it is not surprise that the state requires a valid surety bond to protect consumers and the state’s reputation.

Recent Changes tot Alabama Motor Vehicle Dealer Bond Amount

The state has recently made significant changes to the surety bond requirement through House Bill 393. The changes go into effect October 1st, 2020. The new amount required for an Alabama Motor Vehicle Dealer Surety Bond is $50,000. This is twice the old required bond amount of $25,000.

Can I Increase the Amount of My Existing Motor Vehicle Dealer Bond?

Unfortunately, the answer is no. Existing Motor Vehicle Dealer Bonds will need to be cancelled and replaced with a new $50,000 bond.

How Do You Obtain a $50,000 Alabama Motor Vehicle Dealer Bond?

The new $50,000 requirement will require a credit check for most surety bond companies. This may or may not be an underwriting change from before. Many surety bond companies were already requiring a credit check to obtain these bonds. However, they were instant issue with some surety bond companies. The new limits will likely require a personal credit check for all applicants. You can purchase the Alabama Motor Vehicle Bond directly buy clicking the button below.

Can I get an This Motor Vehicle Dealer Bond with Bad Credit?

The short answer is yes. We have an instant issue program for those with a 650 credit score and above. For those with less than perfect credit, these bonds are still obtainable, but the rate may be higher.

What Do Alabama Motor Vehicle Dealer Bonds Cost?

These surety bonds start at low as $350 per year depending on the surety bond company and the applicant’s credit. Most bond companies will give you a discount for purchasing multiple years in advance. For example, we have one surety bond company who will provide a 3-year bond for $875 for those that qualify.

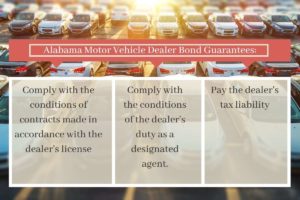

What Does the Alabama Motor Vehicle Dealer Bond Guarantee?

The surety bond guarantees that:

- “the motor vehicle dealer, motor vehicle rebuilder, or motor vehicle wholesaler shall comply with the conditions of any contract made by such dealer in connection with the sale or exchange of any motor vehicle and shall not violate any of the provisions of law relating to the conduct of the business for which he is licensed.”

- “Shall also be conditioned upon their performance of their duties as a designated agent under Chapter 8 of Title 32.

- “The penalty provisions provided under this article, in addition to the tax liability incurred under Chapter 23 of this title on the sale of a motor vehicle, may be assessed against the bond.”

In short, the surety bond guarantees that the license Master Dealer acts honestly, and in accordance with the regulations of the state of Alabama as both a dealer and as a bonded agent of the state. Further, the bond also protects against the tax liability of the Master Dealer. This provision could complicate the underwriting of these Motor Vehicle Dealer Bonds in the future is surety bond companies end up paying for tax liabilities.

Claims Against against the Bond

Claims should be avoided at all costs. If a claim is made against the surety bond, the surety bond company will have to investigate the claim. If a legitimate claim is paid, the surety bond company will seek reimbursement from the Principal for any losses. Master Dealers should not confuse a bond with insurance.

Additionally, Alabama Code 810-5-12-.03 outlines the process for making a claim against the bond. This includes:

- In order to make a bond claim, a claimant must first secure a final judgment from a court of competent jurisdiction. 2.

- A person wishing to make a bond claim must exhaust all available remedies in attempting to collect the judgment, prior to making a bond claim with the commissioner.

- The following items must be submitted to the commissioner in order for a bond claim to be processed.

- A complaint relating to the violation of the conditions of a contract made in connection with the sale or exchange of a motor vehicle; or the violation of any provision of law relating to the conduct of the business of a motor vehicle dealer, motor vehicle rebuilder, or motor vehicle wholesaler, or automotive dismantler and parts recycler.

- A final judgment relating to the complaint in item (a) above. The judge rendering such must sign the judgment. No certificate or any other document that is not signed by the judge will be accepted.

- A description of efforts made to enforce the judgment; along with a statement of all amounts recovered, or a statement that no amount has been recovered. Revenue Chapter 810-5-12 Supp. 12/31/17 5-12-9 (5) The following procedures will be followed when processing bond claims: (a) Upon receipt and review of the required documents, the Department will determine if the motor vehicle dealer, motor vehicle rebuilder, motor vehicle wholesaler or automotive dismantler and parts recycler has in fact violated the provisions of Title 40, Chapter 12, Article 8 or 9, as evidenced by the documents presented. (b) If additional information is required, the plaintiff will be contacted. (c) Upon receipt of the properly completed documentation and after determining that a violation has occurred, the Department shall file a claim with the surety company of record. The maximum amount of the claim filed cannot exceed the value of the bond.

- Upon receipt of the claim, the surety company has 30 days to remit the payment or request an extension to further investigate the claim.

- The surety company may request additional information from the plaintiff to substantiate the claim.

- Upon determination that the claim is valid, the surety company shall remit payment to the Alabama Department of Revenue.

- The Department shall endorse the check from the surety company and mail it to the plaintiff.

- If the surety company fails to respond by the deadline, a claim shall be forwarded to the Department’s Legal Division for further action. (6) The total amount of all bond claims made against.

Once the surety bond penalty of $50,000 has been reached, no further claims can be allowed against the Motor Vehicle Dealer Bond.

Alabama Bond Form Requirements

- The surety bond must be continuous.

- It must also be approved by the Commissioner and payable to the state.

- The bond must be issued by a surety bond company licensed to do business in the state of Alabama. You can search for those companies here.

- The surety bond must the legal and trade names of the Principal and the mailing address.

- The surety bond must contain the city, county and state in which the business is located.

- The bond must have the address and phone number of the surety bond company.

- The bond must have the issue date.

- The bond must be signed by an authorized person of both the Dealer and the Surety Bond Company.

- The Bond must include a Power of Attorney from the Surety Bond Company.

Once complete, the Motor Vehicle Dealer Bond should be sent to:

Department of Revenue

Motor Vehicle Division

2545 Taylor Rd

Montgomery, AL 36117

Contact Alabama Department of Revenue

Although Alabama increased the limits of the Motor Vehicle Dealer and Authorized Agent Bond, these bonds are still inexpensive and easy to get. You can get one in minutes by clicking here. Auto Dealers in the state need to make sure they get replacement bonds in place by October 1st. Most surety bond companies will prorate the unused time on your existing surety bond, so it is better to act sooner than later. MG Surety bonds works with 25+ surety bond companies to ensure that we can find the best solution for Auto Dealers in all circumstances. Contact us anytime for more information on surety bonds.