The Paycheck Protection Program has had a significant impact on contractors and their surety bonds. However, many contractors have questions about how this may affect their bonding by bringing on additional debt. Many good construction companies have been conditioned to avoid interest bearing debt when possible. However, the circumstances surrounding COVID-19 are extremely rare and unusual. We feel that for most contractors, the benefits outweigh the risks of risks of borrowing. Here is how the PPP could potentially affect contractors, their balance sheets and their surety bond capacity.

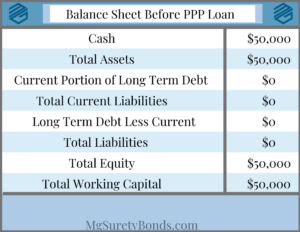

If you are not familiar with the general terms of the PPP, you can check out our article here. For this example, we are going to use some basic assumptions. First let us assume that a contractor has payroll expenses of $50,000 per week. To make things easier, let us assume they have no other debt or liabilities and limited assets.

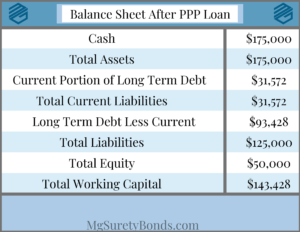

As you can see, based on this simple balance sheet, our contractor has $50,000 of working capital before the PPP loan. Now supposed they borrow under the PPP program and get a loan for $125,000 (2x payroll). The loan term is two years with a 6 month payment deferral and a 1.00% interest rate as outlined here. Now our balance sheet would look something like this:

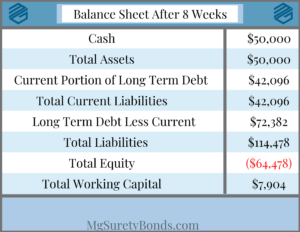

Notice that our equity stays the same. However, our debt to equity ratio went from zero to 2.5. This an important metric for surety bond underwriters. On the positive side, working capital gets a major boost. Our payments are deferred for 6 months so we only have 6 months of payments that would be considered current. However, we are assuming that all the money will be used for payroll. Therefore, at the end of 8-week period, the balance sheet may look more like this:

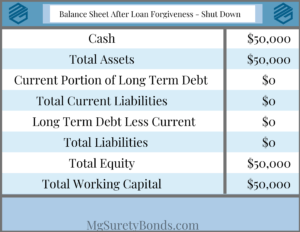

As you can see, the loan proceeds have been spent on payroll expenses, but the loan is still on the books. This causes equity and working capital to fall in our example. However, one of the great features of the PPP is the ability for the loan to be forgiven. This may take up to 60 days though. Here is what that would look like:

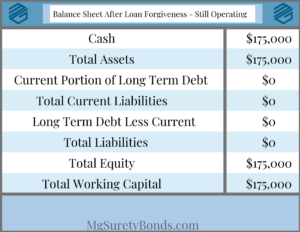

As you can see in this scenario, we are right back to where we started before the PPP loan IF 100% of the loan is forgiven. This is a great deal for contractors or any business, especially in areas where contractors have been forced to stop working. For contractors that have been working, the news is even better for both them and their surety companies. Let us assume the contractor has been deemed “essential” and has been able to continue operating as somewhat normal capacity. We are also going to assume that during this period, their net profit is zero, meaning they have not made or lost money. In this scenario, the balance sheet may look like this:

Because our contractor was able to continue operating normally, they were able to cover their expenses through their job profits and break even. However, they still had their loan forgiven and the cash is now sitting on the balance sheet without any debt tied to it. This is an unbelievable boost for contractors and their surety bond capacity. Assuming a 5% working capital case for their surety bond capacity, this contractor just boosted their bond capacity by $2,500,000 [($175,000 x 20) – ($50,000 x 20)].

Of course, our analysis is very simplified, but should give contractor a good idea how surety bond underwriters will view PPP loans. We believe the PPP has been a tremendous help for contractors that could qualify. For contractors that were able to continue operating, this should provide a positive boost to your surety bond credit. Even if some or all the loan is not forgiven, we believe a loan with a 1% interest rate should be utilized to boost a contractor’s liquidity. Please reach out to us anytime with questions on how this may impact your surety. Our people are surety experts and here to help.