On July 1, 2020, Arkansas made an important change to their contractor licensing code. The changes allow Arkansas contractor to post a surety bond in lieu of financial statements.

Background of the Requirements

Per Arkansas Code 17-25-304, contractors were previously required to provide the state either a Reviewed Financial Statement or a Compiled Financial Statement depending on the size of the work being performed. However, as of July 1, 2020, contractors now have the option of posting a surety bond instead of providing these financial statements. Section 11 17-25-304 (C) of the Arkansas Code now reads, “ (1) In lieu of providing a financial statement for a person or 19 entity required to be licensed or registered by the Contractors Licensing 20 Board as required by subsections (a) and (b) of this section, an applicant 21 may provide a surety bond” This could be a great alternative option for many contractors.

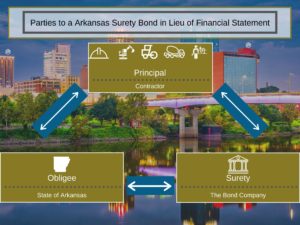

Parties to an Arkansas Surety Bond in Lieu of Financial Statement

The State of Arkansas is the Obligee on the surety bond and this is a requirement of the bond. The Principal is the Contractor and the Surety is the bond company making the guarantee.

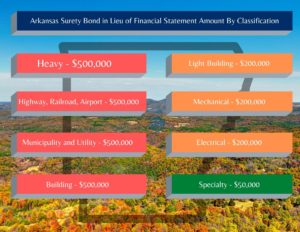

Amount of the Surety Bond in Lieu of Financial Statement

The amount of the bond needs to be ten times the required net worth for each applicant’s classification. The required surety bond amounts are as follows:

- Heavy – $500,000

- Highway, Railroad and Airport – $500,000

- Municipality and Utility – $500,000

- Building – $500,000

- Light Building – $200,000

- Mechanical – $200,000

- Electrical – $200,000

- Specialty – $50,000

What Does the Bond Guarantee?

The bond is for the benefit of any person who is damaged by any of the following:

- An act or omission of the applicant constituting a breach of construction contract or a contract for the furnishing of labor, materials, or professional services for construction undertaken by the applicant; or

- An unlawful act or omission of the applicant in performing the services of a contractor as defined under § 17-25-101

Specifically, the bond says, “NOW, THEREFORE, if the Principal, in compliance with Ark. Code Ann. § 17-25-101 et. seq., does not engage in an act or omission constituting a breach of construction contract or a contract for the furnishing of labor, materials, or professional services for construction undertaken by the Principal, or does not commit any unlawful act or omission in performing construction, then this obligation shall be void; otherwise it is to remain in full force and effect.”

The State of Arkansas has priority over all other claims to recover against this bond.

Duration of the Bond in Lieu of Financial Statements

Arkansas requires that the bond is continuous in nature. That means the bonds continues to renew and be in force as long as the contractor maintains a license or registration in the State. The bond can be cancelled by either the Surety (Bond Company) or the Principal (Contractor) by giving sixty days written notice to the Arkansas Contractor Licensing Board prior to cancellation. However, the contractor will need to either replace the bond with another surety bond or provide adequate financial statements to the State to continue operating. Failure to do so will result in the contractor having their license suspended.

Cost of an Arkansas Surety Bond in Lieu of Financial Statement

The cost for these bonds is 1% for most contractors. However, these surety bonds are issued based on the credit of the Principal (Contractor). Contractors with credit challenges may have higher rates. There are options for Contractors in most situations though.

Other Requires for the Bond in Lieu of Financial Statement

The State of Arkansas requires that this bond be written by a surety bond company who is authorized to transact business in the State of Arkansas. The surety bond company is also required to be listed on the United State’s Department of Treasury’s 570 Circular. You can find a list of those companies here. We also encourage contractors to check to make sure they are getting valid bond. You can read more about that here.

An Arkansas Contractor License Bond is Still Required

This new regulation allows a contractor to provide a surety bond in lieu of financial statement. However, licensed contractors in Arkansas are still required to have an active Arkansas Contractor License Bond. This new regulation does not change that requirement. You can read more about obtaining these surety bonds here. Additionally, contractors may still need other Contract Bonds such as bid bonds, performance bonds and payment bonds. These bonds have separate requirements.

Contractor Indemnity Is Required

Surety bonds are written on the Principle of Indemnity and the Arkansas Surety Bond in Lieu of Financial Statement is no exception. Contractors receiving this bond will be required to sign a General Indemnity Agreement and agree to reimburse the surety bond company for any losses they pay out.

It is important for Arkansas Contractors to be license and provide the proper surety bonds when necessary. In fact, effective July 1, 2020, it will be a Class “A” misdemeanor to work without a license when one is required. Obtaining license bonds is a simple process and the State has made it easier by allowing contractor to post a Surety Bond in Lieu of Financial Statement. MG Surety can help contractors in all situations. Contact us anytime. We look forward to serving you.