Several years ago, Senate Bill 1092 was approved, which revised the existing surety bond requirements for all construction trucking service brokers in the state of California. This bill was signed into law in September of 2012 and it went into effect in January of 2013.

Before this law went into effect, brokers offering construction trucking services were required to post a $15,000 minimum California surety bond to make sure all contracted subhaulers whose services were brokered received fully payment, without issue.

According to California law, not securing the surety bond is considered a misdemeanor and it can result in a fine of up to $5,000. Even with these penalties in place, California construction truckers are concerned that unethical brokers are going to disregard the requirements, which may cost truckers the payment that they have earned.

If you believe you need this surety bond for your business, but are not sure how to go about acquiring it, keep reading. Here you can learn more about California construction trucking bonds, how to get them, what they cost, and what consequences you may face if you do not meet the rules and requirements.

What Does the Bond Guarantee?

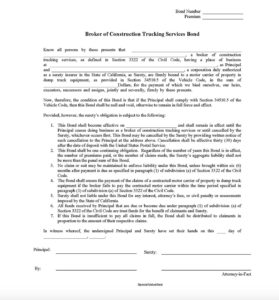

The surety bond guarantees that the Principle will comply with Section 34510.5 of the California Vehicle Code. Further the bond provides protection to contracted motor carriers for payment in a reasonable amount of time. The surety bond remains in effect continuously until replaced or cancelled. A copy of the surety bond is below:

Bond Enforcement

As mentioned above, the law in place makes it a misdemeanor offense if the proper surety bond is not in place. This means it is up to a law enforcement agency to cite the violator and to impose this fine. Usually, this is done by the District Attorney’s Office in the local area, but it may be a city attorney or Attorney General’s Office who takes care of these fines.

To prevent unscrupulous brokers from being able to “game the system” the new law requires that all brokers disclose a copy of the surety bond they have each year. This is going to help subcontracted construction trucks know if the broker they are working with is bonded and if they will have protection under the surety bond. These trucker can file a claim on the bond if they do not receive promised payment for the services provided to the broker. Like all surety bonds, these bonds are written on the Principle of Indemnity. That means that if the surety bond company pays a valid claim, they will seek reimbursement from the Principal on the surety bond as well as any indemnitors. This is a major difference from insurance and should be understood before obtaining a surety bond.

How to Get the Bond Needed

These surety bonds are easily obtainable through a signed application which includes an indemnity agreement and a credit report. MG Surety Bonds works with many surety bond companies who can issue these instantly. That means the customer can usually get them the same day. For applicants with solid credit, one-year pricing starts at $225. Those with imperfect credit can still obtain these surety bonds but it may be at a higher price. Customers can also get discounts for buying multiple years in advance. Contact MG Surety today for help with California construction trucking bonds.