If you have ever watched a home improvement show, you know how excited the producers get over the demolition. In truth, most demolition contracts are much more complicated than throwing a sledgehammer through some drywall. On a commercial project, it is a heavily planned and important part of the overall job. Often, these contractors need surety bonds just like other trades. However, these demolition bonds are considered a hazardous class of contract surety bonds. They are underwritten differently by most underwriters and many surety bond companies will not write them at all. Let’s review some of the underwriting factors and discuss how demolition contractors can make it easier to obtain surety bonds.

Source of Profit

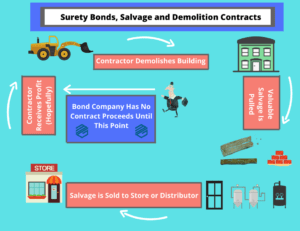

Like all contract surety bonds, underwriters will consider the 3 “C’s” when underwriting a demolition contract. However, the financial piece can be different for demolition contracts. Often these contracts are bid with salvage in mind. This means that the contractor is relying on salvaging and selling material or equipment for part or all the profit on the job. This salvage can be anything from windows and doors, wood, fixtures, boilers, etc. The contractor takes a big risk in doing so. They will incur costs upfront for demolishing the project including overhead, equipment, and labor. Often there are other costs with salvage including cleaning the material, storing it and transporting it. Once it is sold, there is no guarantee that the contractor will find a buyer or that they will receive their estimated selling price. Surety bond companies get very concerned when much of a contractor’s profit is salvage. If there is a claim on the bond, the surety bond company is often left with nothing to offset their expenses. Demolition contractors can make getting surety bonds easier by bidding projects with good cash flow and profit. Salvage should be a nice bonus.

Experience Matters

Experience is important for all contract surety bonds but especially in demolition. Doing demolition on a two-story house is quite different than bringing down a ten-story building in a busy city. Demolition contractors for complex projects should be highly qualified and show relevant experience on similar projects. Hazardous material could vary by job as well and the contractor needs to be familiar with handling such materials or have subcontractors with these qualifications. Surety bond underwriters may expect a detailed demolition plan including a building survey, proposed safety measures, subcontracted trades and a plan to remove materials from the site.

Liability Insurance

Demolition may be one of the most hazardous trades in construction. In fact, OSHA has its own standards for this class because of the unseen risks. The use of explosives, falling buildings, debris, dust, and many other liabilities exposure could come back against a demolition contractor. A large liability insurance claim could easily take a contractor out of business or significantly hurt their balance sheet. As such, surety bond underwriters will want to ensure that the contractor has significant liability limits before undertaking any project. This threshold is often higher than the requirements for other trades due to the high-risk nature of the demolition business. Contractors wanting demolition surety bonds should expect to provide a certificate of insurance to the surety bond company with appropriate limits.

Demolition bonds can be tough, and few surety bond companies like to write them. Having good experience, good profit, proper insurance and plan will make getting these surety bonds easier for contractors. MG Surety Bonds has many surety bond companies interested in supporting demolition contractors and we have the expertise to help you get a bond on any project. Contact us today.