The most popular method for construction project delivery is still design-bid-build. This is where a design professional and owner create plans for a project before sending the project out to bid. A contractor is then selected to build the project. However, that is changing. According to a study by FMI last year, Design Build projects are growing and its anticipated that 45% of nonresidential construction spending by 2021 will be design build. Further, according to the Design Build institute of America, design build continues to expand into smaller project sizes and over half of owners have already used it or will in the next five years.

How is Design Build Different?

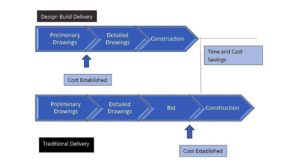

Very simply put, design-build puts all parties together under one roof. The contract for design work and construction are all together. The logic is that by having the owner, designer and builder working collaboratively, the project can be completed with better communication, less errors, less rework, etc. This should in turn speed up the project and reduce costs. However, this article is not to discuss the merits of design-build projects. It is to prepare contractors so they can provide contract surety bonds for them. A visual of both delivery methods is below:

Who is Designing the Project?

Many great General Contractors now have design professionals on staff. A surety bond company will want to know if that person has experience in the scope being designed. For example, treatment plants require different design expertise than hospitals. If you are doing the design work internally, make sure you have the right people. On the other hand, many design build projects involve a contractor subcontracting the design work to a design firm and a surety bond company may want to know their qualification. Again, the contractor will ultimately be responsible for the success of the project. Regardless of who is doing the design work, proper insurance is necessary.

Insurance Is Important

Design work is tricky and faulty plans, drawings, calculations, etc. can lead to big financial consequences. When bonding a design build contract, the contractor assumes all those liabilities. Therefore, a surety bond company will want to make sure that you have your own professional liability insurance with appropriate limits. This applies regardless of whether you have a design person in house or are hiring a design firm yourself. Often, I hear push back from contractors when they are hiring a design firm. They argue that it is an unnecessary cost because the design firm already carries the insurance. Unfortunately, this argument will not change the perspective of your surety bond company. The reason is because you, and therefore your surety bond company are ultimately responsible for the project. There is no guarantee that the design firm’s liability will protect you. This is the point in the article where I tell you I am not an insurance expert, nor do I pretend to be. However, I have been in the construction surety business long enough to learn a few things. First, I have found that many Errors and Omission insurance policies held by architects and engineers specifically exclude claims based only on contractual liability such as hold harmless agreements. In other words, they do not want to cover entities who are not design professionals and there may be no coverage for the Principal contractor.

Secondly, and I cannot stress this enough, the limits will likely not be enough to protect both of you. Claims in these situations tend to be very large and policy limits are exhausted quickly. We once had a contractor file a claim against the architect only to find that there were already three pending claims against his policy, and no protection left for our contractor. You can imagine how that went. If you are going to do design build work, your surety bond company expects you to have professional liability insurance.

Design Build Surety Bond Rates

Design Build projects are considered riskier by surety bond companies because of the design exposure. Therefore, contractors should expect to pay higher rates. Usually this comes in the form of a surcharge to your existing rates scale. For most bond companies, this is usually a 20% – 50% surcharge. In other words, if you pay a 1% bond premium now, plan on paying 1.2% – 1.5% for design-build contracts. You can read more about performance and payment bond rates, including design build projects here.

Watch the Warranty Period

As with any project, you should review the contract and bond forms. This is especially true in design-build construction. When the Design Build Institute developed their new bond forms, they consulted both the National Association of Surety Bond Producers and The Surety and Fidelity Association of America to get feedback and receive their endorsement which was a great idea. Unfortunately, one of the takeaways was that the longest warranty that could be obtained was about five years. Therefore, their bond forms allow up to a five-year warranty. That is the equivalent of asking how far Aaron Rodgers can throw and expecting your favorite college QB to do the same. It’s possible for some but should not be expected. Bond companies are hesitant to go longer than three years for most contractors and two years is the standard. You can read more about that on our maintenance bond page. A best practice would be to negotiate two years or less on any project delivery method.

Design Build projects can be complicated by providing surety bonds for them should not be. If you are a contractor who needs a surety bond and someone with the expertise to help you, contact MG Surety today!