Continuity and succession planning are important to bond companies. There are many ways in which contractors can accomplish the transitioning of their business. One popular method we are seeing more of is the Employee Stock Ownership Plan (ESOPs). ESOPs are a tax-qualified retirement plan that invests in the stock of the company. They can be a great way for owners to get their money while continuing the operations of the company. However, many contractors need surety bonds and careful consideration should be given to how ESOPs can affect surety bond credit. Here are some advantages and disadvantages of ESOPs for contractors and how to set up an ESOP to please your surety bond company.

How Does an ESOP work?

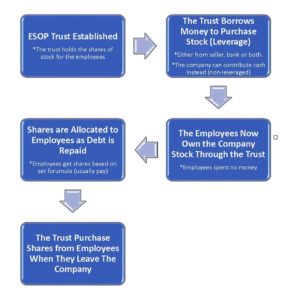

Once the owner(s) decided to sell to an ESOP, an ESOP trust is set up. This trust holds the shares of the company and essentially has all the same regulations as other retirement plans. The trust is then funded by capital from the construction company, which is rare or it can borrow the money from a bank, selling shareholder or both. If the trust borrows money, it is called a leveraged ESOP.

The ESOP trust then takes that money and buys some or all of the selling owner(s)’ stock. As the debt is repaid, the stock is allocated to the company employees. Over time, the selling owners get their money, the company continues, and the employees become the new stockholders. The graphic illustrates the process:

ESOP Advantages:

The Owners Created a Market for the Company

One big challenge in transitioning any company is finding the right buyer. Contractors can have difficulty getting fair market value from an outside buyer because much of their business is considered “blue sky”. Internal buyers often do not have the capital necessary to purchase the assets. With an ESOP, the sellers get a fair price and a willing marketplace.

Employee Retention and Morale

In a tight labor market where contractors are fighting to hire and retain good employees, ESOPs are a differentiator. Employees now directly share in the company’s success. Many executives at ESOPs have told me that this has changed the behavior of their staff and helped to maximize the company’s growth. Additionally, employees get to keep their jobs which is not a guarantee if the owner(s) were to sell to an outside party or close down the company.

Taxes

One of the biggest advantages of an ESOP is that they get preferential tax treatment. ESOPs do not pay taxes on a Federal level and most states do not pay taxes either. For a cash-intensive business such as construction, this is a huge advantage. Imagine having another 1/3 of your profit to fund growth instead of paying your tax bill.

ESOP Disadvantages:

Increased Overhead and Compliance

As a retirement plan, your company now has a whole new level of responsibilities. You will have increased costs with being an ESOP such as legal fees, audit and accounting fees, board members costs, etc. I’ve had companies tell me that they underestimated the costs and time that an ESOP would take. For this reason, a contractor needs to have a sizeable number of employees before considering an ESOP. Usually, 50 is employee is around the minimum.

Loss of Control

Usually in leveraged ESOPs, the former owners stay around to manage the company at least until the debt is paid off and sometime after. That does not mean that its business as usual though. Because the ESOP trust is a qualified retirement plan, any person or committee making decisions for the trust is a fiduciary. That means they must act in the best interest of the plan. This could be a challenge for those used to running a privately held business. More on those requirements can be found here.

Cash Flow

Although ESOPs can create positive cash for contractors through tax savings, they can create cash burdens as well. In addition to the overhead discussed above, there will be an additional debt load tied to any borrowings. Further, the trust will have to buy out employees’ stock as they retire or leave for other opportunities.

Hurdles to Bonding ESOPs

Debt

ESOPs can be a challenge for surety bond companies. Because most contractors use debt to finance the ESOP, the company will likely show high debt and negative net worth at the beginning. These are two things most surety bond companies do not like.

Indemnity

Another major hurdle is indemnity. Surety bonds are written on the principle of indemnity. However, ESOPs cannot indemnify. They are regulated by ERISA and exempt from creditors. The new owners may not have enough personal net worth to qualify or they may not want to sign if they have insignificant ownership percentages.

Volatility

Finally, ESOPs can be difficult for contractors because of the volatility of their earnings. Recessions and downturns are especially difficult on contractors and can make keeping up with ESOP related payments and expenses particularly challenging. Further, an aging workforce means that many employee buyouts could come at once and create a major cash strain.

Tips for Maximizing Surety Bond Credit for ESOPs

Find the Right Surety Bond Company and Broker

Although simple, the first thing is to make sure you are working with a surety bond company and a broker who understand ESOPs. Most bond brokers and many smaller surety bond companies do not. They will not be able to support your company or give good advice if they do not understand the process. Ask how many ESOPs they work with. A surety bond company with too few ESOP clients may have a hard time selling their home office on the structure.

Structure the Purchase Properly

One of the most important things to the surety bond company is how to structure the debt so that it benefits the construction company and surety. Most surety bond companies prefer the seller(s) to finance the debt instead of an outside lender or bank. It is much easier to negotiate with the former owner(s) if the company gets in a bind than with an outside party. Also, have the seller(s) carry back notes that can be subordinated to the surety bond company. This will allow the surety bond company to put that towards net worth in their analysis. Another way to strengthen the surety bond company’s case would be for the seller(s) to provide limited personal indemnity until these notes can be paid back. Finally, if the seller(s) are willing, spread the purchase out over a long period with a reasonable interest rate. This will help to ease the cash burden on the company. Avoid outside financing if possible. Surety bond companies have an unsecured interest and do not want to get stuck in second place behind another lender.

Have a Good Plan

The surety bond company will want to see that the ESOP has a strong management team who can keep the company profitable and repay the debt. It would not be uncommon for them to want key people to indemnify as a form of commitment. They also want to see the construction company have a strong plan for the next 5 years on how it will be profitable as well as a projection of cash flow. Make sure these are realistic and hit those projects. Also, have a smart share buyback plan in place that allows the company to purchase the shares of departing employees back over a longer term. This will ease the cash flow burden on the company.

As we have said, continuity planning is important to surety bond companies. An ESOP can be a terrific way for the owner(s) of a construction company to get their money, reward their employees and keep the company running. If set up correctly, it is a mechanism that should allow the company to continue getting the surety bond credit it needs to be successful. At MG Surety Bonds, we are surety bond experts who are familiar with ESOPs and the surety bond companies who write them. We would be glad to answer any questions you may have. We want to be your surety bond broker for life. Contact us today.