A Fuel Tax Bond is a specific type of commercial surety bond used by fuel suppliers, sellers, mixers, etc. It is a requirement to receive licensing for this industry. The surety bond provides a guarantee of payment for fuel taxes.

The purpose of this surety bond is to protect the state and taxpayers. If the Principal on the surety bond does not pay the taxes when mixing, distributing, or selling fuel, the state may file a claim against the Fuel Tax Bond. Like all surety bonds, fuel tax bonds are written on the Principle of Indemnity. That means that if the surety bond company does pay a valid claim, they will seek reimbursement from the Principal and other indemnitors.

There are several types of Fuel Tax Bonds, which include bonds for motor vehicles, marine, and airline transportation operations.

Who Should Have a Fuel Tax Bond?

Mixers, users, sellers, and certain types of fuel manufacturers require this surety bond before they can get licensed. As a rule, if you blend, deal, export, import, or supply gasoline, then you will likely need a fuel tax bond. Additionally, many states require these surety bonds for those that do the same with diesel fuel, dyed diesel fuel, compressed natural gas (CNG) and liquified natural gas (LNG).

How to Acquire a Fuel Tax Bond

Fuel tax bonds usually require the applicant to provide financial statements on the company as well as a completed application. Depending on the situation, personal financial statements may also be required of the owners. The stronger the company’s financial position, the easier and quicker it will be to get approval. Fortunately, there are also many options available to those who do not have the strongest financial position as well. For most applicants, we can get approval in less than 24 hours of receiving the required information.

Why Are These Bond Considered Risky?

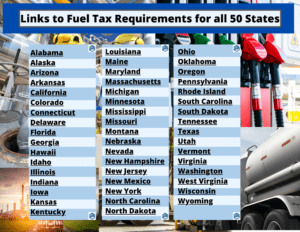

Fuel tax bonds are often considered to be a risky type of surety bond. The reason is that these surety bonds are usually non-cancellable. That means the surety bond company remains obligated to the Obligee, regardless of if the Principal’s financial condition worsens, or if they do not pay the premium. Also, fuel tax bonds are normally written in excess of the amount required to be paid. For example, Texas requires the surety bond to be two times the amount of tax that could accrue during a reporting period. Missouri on the other hand, calculates the requirement as the number of gallons of fuel multiplied by the fuel tax rate, and multiplied again by a three-month period. Each state is different, but many other states have similar types of requirements. You can find a link to each state’s fuel tax requirements by clicking on the image below:

The Cost of a Fuel Tax Bond

The cost of the fuel tax bond is determined by the financial strength of the Principal. These surety bonds can be much less than 1% for strong qualified accounts, and may significantly higher for those with less qualified financial statements. The highest rates are usually reserved for those who are already behind on their taxes, however. MG Surety Bonds works with 25+ surety bond companies and can get the best pricing for all types of situations. Simply contact us today. Keep in mind that fuel tax bonds renew annually with most surety bond companies.

What to Look for in a Fuel Tax Surety Bond Company

Most states have requirements for the surety bond company. Usually, these requirements are that they are licensed in the state and not a surplus lines carrier. Additionally, they should be rated A- or better by AM Best and listed on the US Treasury’s 570 Circular. You should also always verify the surety bond to make sure you get the protection you are paying for and not a fraudulent surety bond.

Indemnity Required

Remember that if you do not pay your fuel tax and the surety bond company suffers a loss, they are entitled to seek reimbursement under the indemnity agreement. You can read more about that process here.