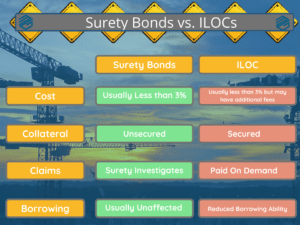

Often business must make a choice between surety bonds or letters of credit to guarantee their obligations. While there are some similarities between letters of credit (also called an Irrevocable Line of Credit or ILOCs) and surety bonds, there are also serious differences between them. Businesses should understand these differences so they can make betters choices.

What are Surety Bonds?

Surety bonds are three-party agreements between the surety, obligee, and principal. Generally surety bonds guarantee a contract or the performance of a duty or obligation. If you do not meet your obligations, someone can file a claim against your bond.

Unlike an insurance claim, if there is a claim on the bond, the surety will seek reimbursement from the indemnitors on the bond. This is known as the Principle of Indemnity. You can read more about that here.

What is a Letter of Credit?

This is also a three-party agreement, but it’s between a bank, borrower, and beneficiary. The letter of credit is a cash guarantee that beneficiaries will be paid for the services or goods provided to a buyer.

If the buyer does not pay for the services or goods provided to the beneficiary, they can use the letter of credit to gain access to the funds that the bank has held in the letter of credit. Irrevocable Letters or Credit cannot be cancelled by the borrower.

The Difference in Claims

If a claim is made against a surety bond, the company must investigate the claim to figure out if it’s valid. The surety company is responsible for only paying legitimate claims.

With a claim against a letter of credit, banks only must verify the correctness and receipt of the documentation required of the letter of credit before the beneficiary is paid. The bank pays letters of credit when it is demanded. That means and Obligee can draw on the letter with little or no recourse. When there is a dispute, it may be a costly and timely process trying to recover the funds.

For this reason, Obligees often prefer letters of credit because its easier to access the funds. This is also the reason a company may want to use surety bonds as there are more protections in place for them. Further details about claims can be read about here.

Costs of Surety Bonds vs. Letters of Credit

If you need to purchase a $50,000 bond, you only pay a percentage of the bond. This amount is usually between one and three percent depending on the obligation and financial strength of the Principal. For construction surety bonds, the rate is usually a sliding scale that ends up being one percent or less. You can read more about contract surety bonds rates here. For commercial surety bonds, the rates are often less than one percent for strong Principals.

A letter of credit usually costs one to three percent of the amount that is covered. However these rates are more volatile and fluctuate with the general economy. Letters of credit often require other fees as well such as origination fees and utilization fees.

Surety Bonds vs. Letters of Credit on Construction Projects

Obligees should understand that on construction projects, surety bonds provide twice the protection for the same costs. For example, let’s assume we have a contract for a $100,000 construction project. Typically a 100% performance bond and a separate 100% payment bond would be issued together for one price. That means the obligee has $100,000 of protection for performance issues and an additional $100,000 for payment issues on the project. This is not the case with Letters of Credit. They are issued at face amount. Claims for $100,000 of payment issues would leave no additional funds for performance claims and vice versa.

Security

In order to provide letters of credit, lenders often take a security interest in the assets of the borrower. They “perfect” this interest by making a public filing known as a UCC filing. This in essence ties up these assets and prevents the borrower from being able to sell them or use them to borrow other funds. Surety bonds are considered unsecured credit. Surety bond companies almost never make a UCC filing unless a claim is made against the Principal. This allows the Principal to his those assets for other purposes.

Additional Borrowing

Lenders almost always reduce a company’s borrowing ability by the amount of the letter of credit. That means they have less borrowing capacity for Capital Expenditures, Working Capital, etc. Surety bonds are unsecured credit. The Principal may have a reduction in bond capacity for using bonds, but they hold onto their borrowing ability.

There are exceptions. For example, in construction, if a lender is using accounts receivable to lend against, using surety bonds may reduce the company’s borrowing ability. This is because case laws says that the surety has rights to those receivables on bonded projects. Therefore, lenders often will not lend against bonded receivables.

Surety bonds and letters of credit are both useful tools for a business. Understand they difference will help companies make better decisions about when to use each one. If you are unsure of which option to use, contact us today, we’re here to help ensure you choose the right option. We are surety experts and look forward to assisting you.