Perpetuation planning is an important part of surety bond underwriting and it is important for contractors to start the planning process early. One great way for companies to transfer ownership of their company and maintain surety bonding for the new company is referred to as OldCo/NewCo.

What is OldCo/NewCo?

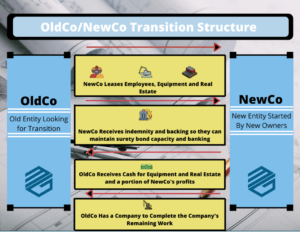

There are a few different ways to structure this but OldCo/NewCo involves setting up a new company for the new owners. The company often has a similar name to the old company but doesn’t have to. For example, Old Company is MG Construction and New Company is MG Construction Inc. The purpose of this would be to keep the ownership transitions as private as possible from the outside world and keep the goodwill that the company has built up over the years.

New Company then leases or hires the employees of Old Company and rents equipment and office space from OldCo. All new contracts are signed in the name of New Company. New Company retains a portion of the profits to build up their cash and net worth and the remainder of the profit is paid out to Old Company for their support. As time goes on, New Company will retain more of the profits until they no longer need Old Company.

Advantages of This Setup:

Surety Bonding

One big advantage of this setup is the ability to maintain surety bonding. For many contractors, the ability to get contract surety bonds is critical to running their businesses. Unfortunately, many strategies for transitioning ownership involve debt and goodwill which may limit or prevent the new owners from getting bond capacity. With OldCo/NewCo the Old Company typically indemnifies for New Company until New Company has the financial strength to stand on its own. This ensures that the New Company has the bond capacity it needs until the transition is final. Once final, New Company should have the balance sheet to qualify for surety bonds on its own.

Low Capital and Tax Requirements

Another advantage of this set up is that ownership can be transferred to those without a lot of capital. Under this setup, the new ownership does not have to borrow money. Again, that helps from both a surety bond and banking standpoint. It keeps debt and goodwill off the company balance sheet. The new owners put in sweat equity to build their ownership. Additionally, this is a tax efficient strategy as the stock of OldCo isn’t sold. The company is simply wound down once NewCo can stand on its own.

Liability Run-Off

A big challenge with transitioning a construction company is winding down the work in progress. The work is contractually obligated to be completed but projects rarely end all at once and carrying overhead to finish the work can be expensive. Selling to an outside party compounds this problem as the new buyer rarely wants to be responsible for existing obligations. OldCo/NewCo solves this problem. The Old Company can simply subcontract the work and supervision to the New Company. Eventually, OldCo is wound down and NewCo is not responsible for the long-term liability of all OldCo’s completed work.

Control

OldCo/NewCo is a good structure when the owners of the Old Company still want to maintain control. Because the assets and indemnity are still theirs in the early years, they effectively control both companies for a while. This is often good for family transitions when the future owners are identified early but not completely ready to run the company.

Disadvantages:

Time

The biggest disadvantage is that this structure takes time. The setup won’t work for an owner who wants to get their money quickly as they are essentially buying themselves out with their own money.

Alternatives:

One of the things I like about the Oldco/NewCo structure is how flexible it can be. For example, what if a seller does want the owner to have “some skin in the game” and make a financial commitment? Well in this structure, they could buy the equipment or purchase the building instead of leasing them.

We also have a lot of flexibility on the surety bond program. For example, instead of OldCo giving full indemnity, we could limit the OldCo indemnity to a certain dollar figure. We’ve also set this up where OldCo has no indemnity. In that situation, the shareholders of OldCo purchased Preferred Stock in NewCo that was equal to the amount needed to support their surety bond program. We were able to get an agreement with NewCo that the preferred stock couldn’t be redeemed without the permission of the bond company which allowed us to show it as equity. The OldCo owners are then paid a dividend.

Another possibility with the OldCo/NewCo strategy is to set up a third entity. OldCo and NewCo then joint venture through this entity. Similarly, OldCo would contribute employees, capital and equipment and NewCo contributes sweat equity.

Perpetuation planning is an important part of surety bond underwriting. Underwriters want to know that contractors have a plan so that obligations can be completed and that significant amounts of money will not have to come out of the construction company. OldCo/NewCo is a great way to accomplish this and keep surety bond capacity in place. It keeps cash in the new company and debt and goodwill off the balance sheet. We think it’s a great strategy for family-owned construction companies or those who have identified quality internal individuals.

If you are a contractor who needs a surety bond and someone with the expertise to help you, contact MG Surety today. We want to be your bond broker for life!