It is said that, “The only man who sticks closer to you in adversity than a friend is a creditor.” Debt can put a stranglehold on a contractor. It creates the need for more volume and profit just to cover interest obligations. It can be difficult to get rid of when times are tough. That is one reason that surety bond companies will look so closely at a contractor’s debt level. It stands to reason that most companies want to get out of debt but you may want to think twice if you are doing bonded work. Paying off debt could actually hurt your surety bond capacity. Below are some things contractors should consider, and discuss with your surety bond broker before making any decisions regarding debt repayment.

Consider What Type of Surety Bond Company

Surety Bond companies look at many things that typically fall into 3 categories, Character, Credit and Capacity. All of them will do trend analysis on a number of different items but generally speaking, they will fall into one of two categories. They are either “working capital” capital underwriters or “net worth” underwriters. As a side note, some surety bond companies will call themselves “cash flow” underwriters but my experience says that these companies are very similar to “working capital” companies. Both types of companies have advantages and disadvantages. However it’s important to know your surety bond company’s philosophy before paying down debt.

Working Capital Surety Bond Companies

Most surety bond companies are “working capital” underwriters. When it comes to surety bonding, they value liquidity. They know that contractors typically get into trouble when they run out of cash. As a quick refresher, working capital is determined by taking a company’s current assets and subtracting their current liabilities. Although other things are important to them such as profitability and debt levels, these types of surety bond companies will largely base a contractor’s surety bond program on their analyzed working capital.

A contractor with a working capital surety bond company needs to carefully consider the impacts before paying off any debt that could decrease working capital. Let us look at the following example.

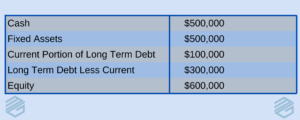

Let us say a contractor has $500,000 in cash, $500,000 in fixed assets with $400,000 borrowed against those assets. Let us assume that $100,000 of that debt is current or due within the next 12 months. That balance sheet would look something like this:

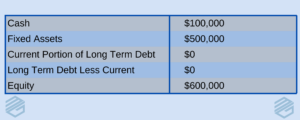

In the example above, our contractor has $400,000 of working capital ($500,000 – $100,000). Assuming the bond company gives him capacity of 20 times working capital, the company has a surety bond program of $8 million. Now let us say that our contractor decides that he/she is tired of paying interest. He/she then decides to pay off their debt. The balance sheet may then look something like this:

Many contractors would think this is a smart decision. After all, equity remains the same and now the company has no debt or interest payments. Unfortunately, the contractor just significantly reduced their surety bond capacity with a working capital company. Working capital has now decreased from $400,000 to $100,000 ($100,000 – $0). Again, if we assume a 20 times program, their surety bond capacity has just decreased from $8 million to $2 million even though they thought they were making a wise business decision. I’ve worked with a number of unhappy contractors who made this mistake and were surprised by their surety bond company’s response.

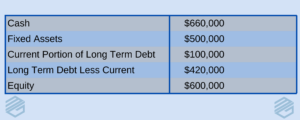

Now let me give you the positive side of debt, and how it can be used when working with a working capital surety bond company. Again, other factors will play in but let’s assume in the original example that a contractor wanted to pursue additional work and increase their surety bond program to $10 million. Unlike equity, we can “manufacture” working capital. Suppose they were to use their fixed assets and go to their bank to borrow money. They borrow another $160,000, and $40,000 of that loan is the current portion of the debt. Our balance sheet would then look something like this:

You will notice that once again, equity in the company has not changed at all. Debt has increased and working capital has increased to $520,000 ($660,000 – $140,000). Now a 20 times surety bond program gets them to surety bond capacity of $10.4 million.

Net Worth Surety Bond Companies

Net worth companies as you might guess look more at the company’s equity position than the working capital. When it comes to surety bonding, they do tend to be more debt adverse than working capital surety bond companies, however. Fixed assets that are free and clear give a company more flexibility than assets with a heavy debt burden. There a far fewer surety bond companies that are considered net worth companies compared to those that are working capital surety bond companies.

Let us look again at our earlier example of using our cash to pay down debt:

This would likely be a positive for a net worth surety bond company as our equity remains the same and our debt has decreased. On the flip side, borrowing to increase our surety bond capacity will not help us. It does not increase our equity, and it increases our debt load.

So which option is better for contractors? The answer is that it depends on each contractor, and their unique situation. Debt is an important piece of surety bonding but there are also many other factors to consider. MG Surety works with both working capital and net worth surety bond companies for that reason. The real take away for contractors is that you need to be partnering with a surety bond expert who understands surety bonding and construction. Even though it seems logical to pay down your debt, you need to consult with that surety bond expert before making any major repayment decisions. Making the wrong decision could leave you frustrated and scrambling for surety bond capacity. At MG Surety, we are surety bond experts and work with contractors to help them make the best decision for their surety bond needs. Click here to get in touch!