The Financial Accounting Standards Board (FASB) began to overhaul the lease standard approximately 13 years ago. Educational materials can be found on their website. The new standard became applicable to private companies on December 15, 2019 (which means it is already in effect). Note that this change only affects private companies, as public business entities were already using the new standard.

Do the New Rules Apply to Your Construction Company?

The answer is likely yes. Any business following Generally Accepted Accounting Principles (GAAP) are required to implement the new requirement. Contractors who need Contract Surety Bonds and therefore CPA prepared financial statements will be subject to these requirements.

Pro Tip: The biggest impact of these changes is going to be to lessees. The lessor won’t see significant changes to the lease accounting practices they have in place.

Impact of New Lease Accounting Requirements on Surety Bond Capacity

The most significant impacts will be to contractors’ financial ratios such as debt to equity. This is very important as surety bond companies and banks have covenants tied to these ratios. Contractors could violate these covenants under the new rules even their operations have not materially changed. Balance sheets under the new requirement will likely grow which sounds like a good thing. However, the offsetting entry will be debt. A study of 3,000 companies by PWC shows an average debt increase of 22% across all industries. Surety bond companies do not like debt and spike of this size may be cause for concern. Heavy contractors who lease equipment could be most at risk as well as those leasing real estate.

The Specific Changes Going into Effect

There are two basic classifications of leases:

- Capital Lease (now called Finance Lease): Involves the transfer of ownership of an asset to a lessee.

- Operating Lease: Transfers the right to use said asset during the term of the lease.

Under the old requirements, operating leases were not recognized on the balance sheet. Instead, rent expenses were recorded on the balance sheet. Part of the new standard has been created to help improve transparency and comparability of financial statements. This was achieved by requiring most leases to be included on the balance sheet. The new requirement referred to as “the right-of-use” requires companies to recognize a right-of-use asset and a lease liability on the balance sheet for what used to be operating leases. This all but eliminates off-balance sheet leases which could have a major impact on a company’s balance sheet.

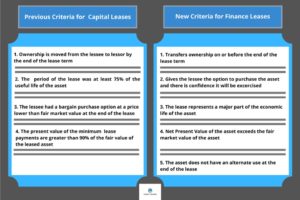

The first thing to do is determine if it’s an Operating Lease or a Finance Lease (previously called Capital Lease). Below is a comparison of the old and new requirements for Finance Leases.

Once a determination is made that it is an Operating Lease, a contractor will then need to decide if it is long or short term. In general, a lease is considered short term, if it is less than 12 months and there is not a purchase option at the end. If the lease meets these terms and is classified as short term, payments can still be recognized short term without including it on the balance sheet. If it doesn’t meet this criterion, it is likely long term, will need to be classified as right-of-use and included on the balance sheet.

Most contractors have some lease obligations and will be impacted by these changes. If you have significant off-balance-sheet leases presently, you need to speak with CPA and your surety bond broker on strategies to minimize the impact on your company and surety bond program.

Fortunately, most surety underwriters are aware of and prepared for the new requirements. Communication will be key for the first year and it helps if you can discuss your plans for how your company will handle its lease obligations in the future. For contractors with significant leases, it would be worthwhile to determine if that is still the best structure. Renegotiating leases, purchasing, etc. may be more beneficial in moving forward.

If you are a contractor who needs a surety bond and someone with the expertise to help you, contact MG Surety today. We want to be your bond broker for life!