What is in a single word? Well a lot if you are a contractor expecting to be paid for your work. Contingent Payment Clauses are very important to surety bond underwriters and they should be to contractors as well. Receiving payment is vital for every for-profit business. This is especially true in construction because contractors are typically not allowed to bill for work until after it is complete and often at the end of the month. That means it is very common for a contractor to have 45 days of project costs before receiving payment for that work. Failure to collect this payment can lead to surety bond claims and/or contractor bankruptcy. For this reason, contingent payment clauses are one of the most important things that contractors and their surety bond underwriters should consider before signing a contract and providing performance bonds or payment bonds.

What is a Contingent Payment Clause?

Contingent Payment Clauses are contractual clauses that condition payment under the contract to some other event such as payment by the Owner. Contractors can often spot these conditions as Pay-if-Paid and Pay-When-Paid clauses. So, what is the big deal? It is only a single word after all. In the eyes of courts, it can make a huge impact.

General Contractor or Subcontractor

To be fair, different parties have different perspectives and most surety bond companies and brokers are play both sides when it comes to this discussion. That includes MG Surety Bonds. The reason is that contingent payment clauses are often good for some contractors and bad for others. Often this is a matter of being a General Contractor or a Subcontractor. We will try to present considerations for both sides as our customers are both General Contractors and Subcontractors. Most surety bond companies face the same dilemma.

Pay-If-Paid Clause

A Pay-if-Paid clause is a way for the General Contractor on a project to pass the payment risk down the chain to Subcontractors and/or Suppliers. The General Contractor will pay Subcontractors “IF” the Owner pays the General Contractor. From a General Contractor’s perspective, this is a great way to shift payment risk and this if often encouraged by the surety bond company. After all, having to pay Subcontractors and Suppliers when the General Contractor cannot collect from the Owner, could put a General Contractor out of business.

From a Subcontractor’s perspective, why should they share in the General Contractor’s payment risk with the Owner? Often, Subcontractors have no direct communication or relationship with the Project Owner. They also do not always get to see the contract between the General Contractor and the Owner, nor do they often get the opportunity to negotiate contract terms with the Owner. Therefore, it is very risky for both Subcontractors and their surety bond companies to accept such a contract. Subcontractors often feel that they have payment protection on a project if the General Contractor has posted Performance Bonds and Payment Bonds. However, these bonds follow the contract and the contingent payment provision is usually a valid reason for the surety bond company to deny the claim on a private project. A case example is BMD Contractors vs. Fidelity and Deposit Company of Maryland. In the case, the Owner filed for bankruptcy leaving $40 million+ in unpaid contractors. BMD Contractors was a 2nd tier subcontractor and made a claim on the upstream contractor’s bond. The court dismissed the bond claim and held that a surety can rely on the Principal’s defense to a bond including the Pay-if-Paid clause.

As you can see, a surety bond company would prefer a Pay-If-Paid arrangement with a subcontractor as it protects the Principal from non-payment by the Owner. However, the surety bond company would discourage their subcontractor from a signing a contract with Pay-If-Paid language as it could prevent the contractor from getting paid for the work they perform.

Pay-If-Pay Legal Considerations

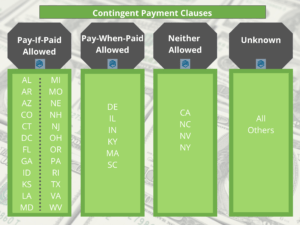

Not all states allow Pay-If-Pay clauses. 24 States recognize Pay-If-Paid clauses when worded properly. These states include: AL, AR, AZ, CO, CT, DC, FL, GA, ID, KS, LA, MD, MI, MO, NE, NH, NJ, OH, OR, PA, RI, TX, VA, and WV. Most of these States require very specific language for Pay-If-Paid to be enforceable.

Pay-When-Paid Clause

One word makes a huge difference. Pay-When-Paid language means that Subcontractors will get paid “when” the Upstream Contractor or General Contractor gets paid. States recognize this language as a timing mechanism. The difference is that courts have usually held that Subcontractors are entitled to payment “eventually”. However, even this could be a considerable amount of time. For surety bond underwriters, this once again depends on where their Principal stands in the hierarchy. For a General Contractor, Pay-When-Paid means that the General or surety bond company may eventually have to pay regardless of whether the General Contractor can collect from the Owner. This is not ideal. On the other hand, if their Principal is a Subcontractor, Pay-When-Paid is preferred as it assumes the Principal will eventually get paid for the work.

Pay-When-Paid Legal Considerations

Seven states specifically ban Pay-If-Paid provisions but allow Pay-If-Paid clauses. These include: DE, IL, IN, KY, MA, SC, and WI. Again, specific contract language is usually a requirement to be enforceable.

Other State Enforcement of Contingent Payments

There are four states that specifically excluded both Pay-If-Paid and Pay-When-Paid language. These states include: CA, NC, NV, and NY. Those states have ruled that these clauses are against public policy and the General Contractor is required to pay Subcontractors regardless of collection from the Owner. General Contractors and their surety bond companies must understand this obligation before operating in those states. You may notice that we are missing some states. That is because not every state has ruled on contingent payment clauses and its not clearly defined at this point. Case law will eventually decide where those states stand. Both General Contractors and Subcontractors should not assume that operating in a state that allows this language will or will not be enforceable. Other factors may come in such as where is the Owner or Upstream contractor located and what venue is the contract enforceable in.

Carefully Review Each Contract with a Surety and Counsel

The purpose of this article is not to provide legal advice but to point out the risks of Contingent Payment Clauses to contractors and explain why their surety bond company may or may not approve a contract with such language. We would advise getting a qualified construction attorney involved any time a contract with Contingent Payment language is being considered. Legislation and case law could change over time and the cost for a good contract review will seem small compared to litigation down the road. Payment responsibilities are too important for General Contractors, Subcontractors, and their surety bond providers to take lightly.