A Work in Process schedule, commonly called a WIP, is an extremely important report for both contractors and surety bond companies. Contractors can benefit by understanding what surety underwriters are looking for in a WIP report.

What is a WIP Report?

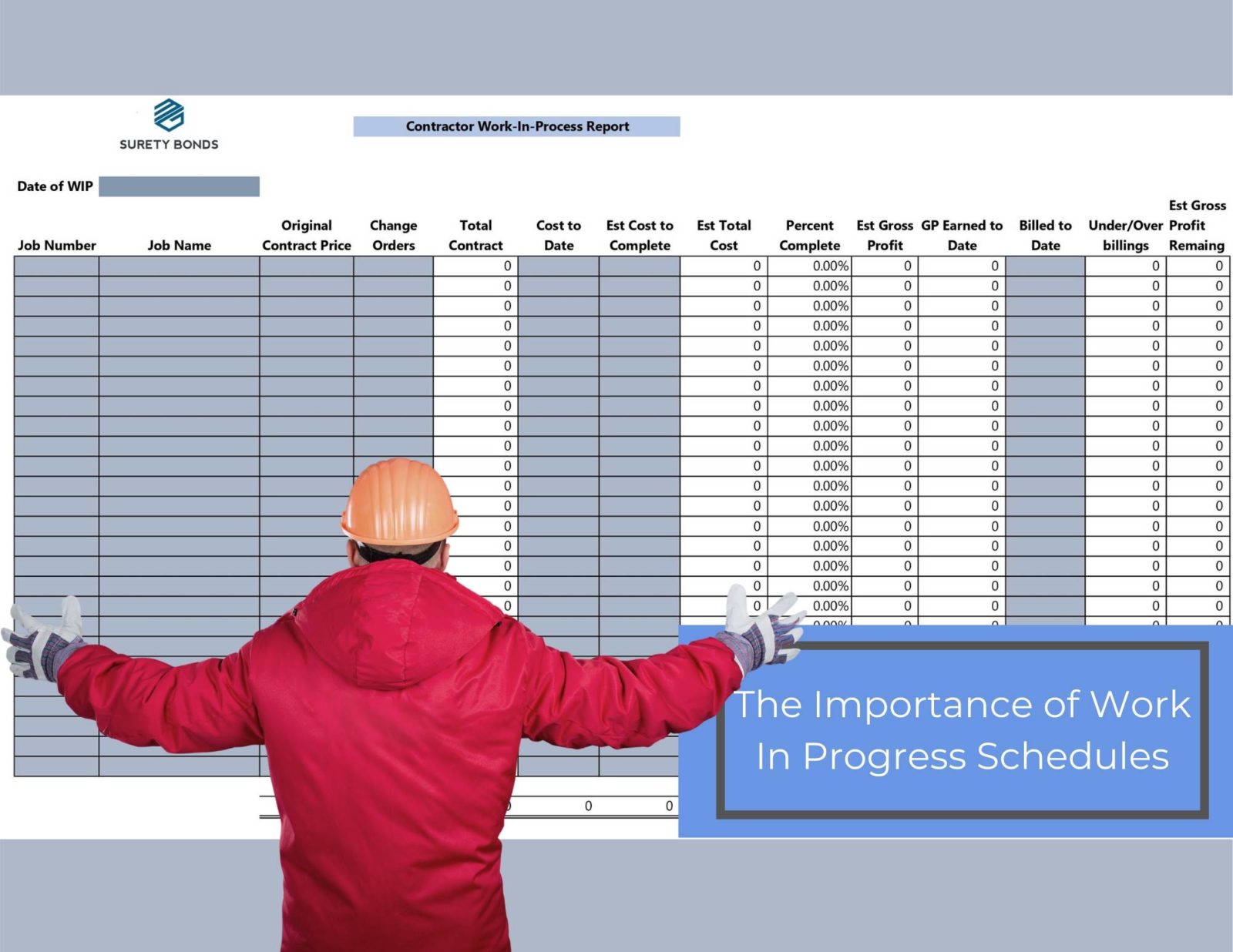

WIP reports are detailed schedules that include information on completed and in-progress contracts for the existing period. Usually, the schedule consists of these columns, but may contain other information based on the construction management software system, too:

- The overall contract price

- The total estimated costs

- The billings to date

- The costs incurred to date

- The estimated cost to complete

- The estimated gross profit

Below is a sample of a work in progress report and you can find the link to a usable version here.

Purpose of a WIP Report

The main purpose of Work In Progress (WIP) reports is to allow contractors and key stakeholders to accurately monitor how their current projects are performing. Projects are constantly changing and it is vital that a contractor knows where their costs and profit (or losses) are on every job at any moment. Losing track of project costs is one of the biggest causes of Performance Bond Claims.

Why are WIPs Important for Surety Companies?

Even though Work In Progress reports are valuable tools for contractors to monitor their contract’s progress, they are also vital to a surety bond company’s ability to underwrite an account. Here are some items that surety bond underwriters look at when reviewing a contractor’s WIP report.

Contractor’s Backlog

A surety underwriter will monitor the total amount of backlog a contractor has at any given time. Most surety bond companies are concerned with a contractor’s Cost to Complete or Left to Bill, as this represents an estimate of the surety’s exposure. Surety bond companies often experience bond claims when a contractor has too much work and they want to make sure the balance sheet supports the work on hand.

Backlog Profit

A surety also wants to make sure there is profit in the backlog. Remaining gross profit on the work in progress report can be a good indicator of is a contractor will be profitable or not. Estimated gross profit exceeding the remaining overhead means that the contractor should be profitable. On the other hand, if remaining gross profit doesn’t exceed overhead, it is a sign that the contractor may need more work. Any profit left in the backlog is there to cover overhead down the road, so the profit remaining in the backlog is compared to the expected overhead.

Underbillings are Overbillings

Surety Bond companies are very concerned with large over and underbilling on each project. Underbillings can signify unapproved change orders or job losses that a contractor cannot bill for. On the other hand, large overbillings means a contractor has collected for work they haven’t earned and will have costs they cannot bill for later in the project. A surety bond underwriter will want to make sure the contractor has cash balances and accounts receivables on their balance sheet to account for this. You can read more about over and underbillings here.

For help with understanding Work-in-Progress for contractors and how surety bond companies use them, reach out to those with experience in these situations. Doing so is going to pay off in the long run and ensure that the desired bond is secured for the contractor.

Profit Trends

Surety Bond companies evaluate the profit for each project. Tracking individual project performance is helpful in analyzing a contractors trends. For example, how is the job progressing compared to the original estimate and last WIP report? Is the gross profit holding, slipping or getting better? Some surety bond companies track these trends by the size of the project, scope of the project and even the Owner or General Contractor. Contractors should note that profits rarely get better once they start to slip and surety underwriters know this. If a contractor shows a history of profit fades, the surety bond company may lose confidence in their estimating or accounting abilities. This almost always leads to the contractor having to find a new surety bond company.

Completed Contract Schedule

Although this article is about a Work in Progress report, a WIP should always be accompanied by a Completed Contract Schedule. A Completed Contract Schedule shows projects that have been completed since the last WIP report. Like the WIP, a Completed Contract Schedule is an important underwriting document to surety bond companies. It shows the final profit and costs for each project. Once again, sureties use this information for their trend analysis. You can find a Completed Contract Schedule here.

Work in Progress schedules can be complicated but they are an important tool for contractor and surety bond companies both. Contractors should ensure that their accounting system accurately tracks each’s projects performance and is capable of generating regular work in progress schedules. MG Surety Bonds can provide contractors guidance on good systems or just answer any questions you may have. We are surety experts. Contact MG Surety anytime.