Contractors in the State of Washington are required to be licensed and have a Washington Contractor License Bond. Each contractor must register with the Department of Labor and Industry (L&I) to perform work. They must also post a Washington Contractor License Bond and evidence of insurance to protect the public.

What Does a Washington Contractor License Bond Guarantee?

The license bond guarantees that a contractor will comply with RCW 18.28.040. This means the contractor will be responsible for the following:

- Wages and benefits to persons furnishing labor to the Principal

- Amounts that may be adjudged against the Principal by reason of breach of contract including negligent or improper work in the conduct of the contracting business

- Persons who furnish labor and materials or rent or supply equipment to the Principal

- Taxes and contributions due to the State of Washington

What is the Required Bond Amount?

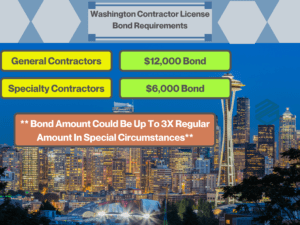

Washington licenses many different specialties. Fortunately, there are only two general classifications for a contractor bond. These are General Construction and Specialty Construction.

General Contractors – Must put up a $12,000 Contractor License Bond. General Contractors can perform most types of work and can work with subcontractors from many trades.

Specialty Contractors – Must put up a $6,000 Contractor License Bond. Specialty contractors are not allowed to subcontract work.

In special circumstances, RCW 18.28.040 allows the Director to increase this contractor license bond amount to up to three times the regular amount in special circumstances. Section 11 says,

“The director may require an applicant applying to renew or reinstate a registration or applying for a new registration to file a bond of up to three times the normally required amount, if the director determines that an applicant, or a previous registration of a corporate officer, owner, or partner of a current applicant, has had in the past five years one final judgment in actions under this chapter involving a residential single-family dwelling.”

Other Bond Requirements

The State of Washington requires that contractor licenses be continuous. That means they remain in place and effective until they are cancelled. The State does give the surety bond company the option to cancel a license bond, provided they give notice in writing. Once a license bond is cancelled, a contractor must either replace the license bond with another or the contractor’s license will be immediately suspended.

What is the Cost of a Washington Contractors License Bond?

The cost of these contractor license bonds are based on the credit of the applicant. Rates start at around $140 a year for those with good credit. Most surety bond companies will also offer up to a 25% discount for purchasing multiple years in advance. The license bond premium will renew annually until the bond is cancelled.

How to Get a Washington Contractor License Bond?

These contractor license bonds are easily obtainable and can be issued within a matter of minutes. Applicants should be ready to provide the information necessary to run their personal credit. This includes the following:

• Name of Business

• Address of Business

• Type of Entity

• License or Application Number

• Ownership Percentages

• Name and address of owner(s)

• Social Security Number of owner(s)

You can also complete our licensing application here if you prefer.

Can Contractors with Bankruptcies or Bad Credit Get a Contractor License Bond?

Generally, yes. Those contractors may be asked to pay a higher rate and/or provide additional documentation.

Alternative to Providing a Washington Contractor License Bond

The State of Washington does provide an alternative for those who do not want to obtain a contractor license bond. Contractors can use an assigned bank account. They can then use cash, money markets and certificates of deposits in lieu of a surety bond. Keep in mind that although this may save a little money, it will also tie up those assets for a long period of time. There also may be little protection in the event of a fraudulent claim against the contractor.

Claims Against a Washington Contractor License Bond

Claims can be filed against the contractor and the surety bond company for the contractor’s breach of contract or failure to pay the amounts owed. If the claim is found to be valid and the surety bond company must pay out, they will seek reimbursement from the contractor. This is referred to as indemnity. The surety bond company is not liable for more than the license bond amount. The state also directs priority of claimants in the following order:

- Employee labor and claims of laborers, including employee benefits

- Claims for breach of contract by a party to the construction contract

- Registered or licensed subcontractors, material, and equipment

- Taxes and contributions due the state of Washington

- Any court costs, interest, and attorneys’ fees plaintiff may be entitled to recover

Other Construction Bonds May Be Required

In addition to getting a contractor license bond, contractors may also need other types of construction bonds including bid bonds, performance bonds and payment bonds. These bonds guarantee different obligations and have different costs and underwriting requirements. Washington contractors can reach out to us anytime with questions on these surety bonds. You can also read more about them with our case study here.

MG Surety Bonds works with many different surety bond companies who write Washington Contractor License Bonds. We will work with you to get you the best rate and terms for your situation. We are not just internet marketers; we are surety bond experts. Please contact us anytime.