As of the date of this blog, there are over 280,000 contractors in the state of California. With so many operating contractors, California like many states requires contractors to be licensed and have a California Contractor License Bond to protect the general public. A California Contractor License Bond is a three-party guarantee between a contractor (The Principal), a surety (the bond company), and State of California (The Obligee). It protects consumers and employees from license law violations. To avoid disciplinary action against their license and license bond, contractors must abide by the rules and regulations that were created by the Contractor State License Board. If a contractor does not comply with the state law, claims may be filed with the surety bond company.

Who Needs a California Contractor License Bond?

A Contractor License Bond must be in place before the Contractor State License Board will issue or renew a license. Therefore, most contractors operating in the state of California will need this type of contractor license bond.

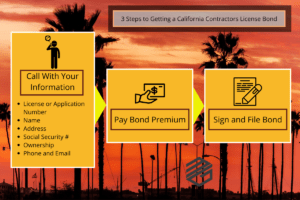

How to Apply for a Contractor Bond

A California Contractor License Bond is easily obtainable through MG Surety Bonds. In fact, they are instant issue and no credit check is required. Simply the button below and complete the online application.

Approval is easy and you can have your California Contractor License Bond within minutes. A contractor only needs their license number, address, contact information and the desired effective date of the bond.

There are also other options to acquire these California Contractor License Bonds at different price points but they may require more underwriting which would include the following:

- Name and address of the business and owner

- Social Security Number (so we can run credit)

- FEIN

- License Number or Application Number – Contractors can look up their status here

- Phone Number and Email

If a contractor chooses to go with this option, we need a signed application that includes an indemnity agreement and that is it. Most applications are still approved and issued in minutes. In some cases, the license bond can even be filed with the state electronically.

Newly Licensed California Contractors

Much like getting California contractors insurance, newly licensed California contractor may have trouble getting a license bond with some surety bond companies. However, our program requires no credit check and newly license California Contractor are acceptable. Click here to get your bond.

How Much Do California Contractor License Bonds Cost?

A California Contractor License Bond is priced based on the personal credit of the application. For applicants with great credit, a one-year bond costs as little as $90 per year. For those with less than perfect credit, these contractor license bonds are still easily obtainable at higher rates. Discounts are also available for purchasing multiple years up front. The longer the prepaid term, the larger the potential discount.

Requirements of a Valid California Contractors License Bond

To be acceptable to the Contractor State Licensing Board, several requirements must be met. Requirements for a California Contractor License Bond include:

- Amount of the bond must be $15,000

- Must be written by a California Department of Insurance licensed surety bond company. A complete list of companies can be found here.

- The signature of the surety bond company’s attorney-in-fact must be present

- The license number and business name on the license bond must match the license number and business number in the CSLB’s record exactly.

- An Attorney General’s Office approved bond form must be used for the license bond.

- The bond has to be turned in at the Contractor State License Board Headquarters Office within a 90-day period from the effective date of the license bond.

Be careful to make sure your surety bond company meets these requirements. Unfortunately, there are fraudulent surety bond companies that will take your money and not meet the state’s requirements. You can read more about verifying surety bonds here.

Other Related California Contractor Bonds

In addition to the Contractor License Bond, other related bonds may be required by the Contractor State Licensing Board. These include an LLC Employee/Worker Bond, a Bond of Qualifying Individual and a Disciplinary Bond.

A California LLC Employee/Worker Bond

A California LLC Employee/Worker Bond is required by all contractors in the state that are a Limited Liability Company. The bond protects the contractor’s employees by providing a guarantee that wages and benefits will be paid. You can read more about these bonds here. They can also be purchase instantly by clicking the button below.

A Bond of Qualifying Individual

A Bond of Qualifying Individual (BQI) is required, in addition to the Contractor License Bond if the qualifier is a responsible managing employee (RME). A Bond of a Qualifying Individual is also required if the qualifier is a responsible managing officer, responsible managing manager, or responsible managing member with less than 10 percent ownership of the voting stock or equity of the corporation or limited liability company (LLC) for which he/she is qualifying. Contractors can read more about the requirement here. The bond amount required for a Qualifying Individual is $12,500. These surety bonds are easily obtainable and priced based on the credit of the individual.

A Disciplinary Bond

A Disciplinary Bond is required when a contractor’s license has been revoked for violation of the Contractors’ License Law. This bond is needs to be filed before the license can be reinstated. Contractors can read more about the requirements here. This surety bond is required to be in place for a minimum of two years. The Registrar will determine the amount of the bond required. However, it may not be less than $15,000, or greater than ten times the Contractor License Bond amount. Contractors that are required to post a Disciplinary Bond will still need a Contractor License Bond as well.

The Basics of the California Contractors Bond

The contractors (principals) of a surety bond agree to comply with the provisions set by Division 3, Chapter 9 found in the Business and Professions Code. The purpose of the bond is to provide protection for harmed parties from a financial loss up to the total amount of the bond if the principal does not comply with the law and the surety bond agreement.

Claims Against a California Contractor License Bond

A claim against these bonds can be filed by homeowners, employees damaged by the contractor’s failure to pay wages, or any person damaged by willful or deliberate violation of the construction contract. A claim must be filed directly with the surety bond company who wrote the California Contractor’s License Bond. The surety bond company will investigate the claim. If the claim is found to be valid, they will compensate the injured party under the bond and then seek reimbursement from the Principal and any indemnitors. This is known as the Principle of Indemnity and bonded contractors should understand that this is a major difference between surety bonds and insurance.

California Contractor License Bond Cancellation

The contractor license bond will remain in effect until they are canceled. The surety has the right to cancel the license bond according to Sections 996.310 of the Code of Civil Procedure. The surety bond company must give 30 days notice to cancel the California Contractor License Bond. Once the Contractor Licensing Board receives a notice of cancellation, the contractor must either replace the license bond with a new bond from a new surety bond company, replace the license bond with a new bond from the existing surety bond company, or get the existing surety bond company to send a reinstatement notice. One of these must be received by the Contractor License Board before the end of the 30 day period or the contractor’s license will be suspended. More information can be found here.

Alternative to California Contractor License Bonds

There are alternatives to using surety bonds. California allows contractors to post either a cashier’s check or a bank certified check instead of a surety bond. These cash alternatives will be retained by the Contractor State Licensing Board for three years after the license period or three years following the expiration, cancellation or revocation of the license. There are some significant reasons why contractors may not want to do this. First of all, that’s a long time to have resources tied up. A California Contractor License Surety Bond does not usually require that a contractor use their liquid assets. This way, a contractor can use those resources in their business, unlike with a cashier’s check or bank check. Also, with a surety bond, claims are investigated by the surety bond company before any payments made. This ensures that the claim is valid. No such defense exists with a cashier’s check and a contractor may be stuck trying to get their money back through litigation.

Verifying the License and Surety Bond

Consumers should verify that their contractor is both licensed and and has an active Contractor License Bond before signing a construction contract. You can check a contractor’s license status at the Contractor State License Board’s website here. You can also request a copy of the contractor’s license bond by submitting a “Request for Current Bond Information” directly to the Contractor State License Board. This is helpful for parties that need to make a claim on the license bond and the fee is $8. We also always encourage all parties to verify the Contractor License Bonds. Unfortunately, there is fraud in the industry and it is important to make sure protection exists.

Additional Requirements

Keep in mind that these California Contractor License Bonds are required by the state for licensing. This does not mean that additional surety bonds will not be needed. Many municipalities will still require contractors to post other license bonds for work done in their jurisdictions. Contractors may also need other Construction Bonds such as bid bonds, performance bonds and payment bonds. MG Surety can help contractors determine what surety bonds they need in all circumstances. We have the best rates, terms and surety bond expertise. Contact us today or purchase a bond directly in minutes. You can also visit our Frequently Asked Questions Page about surety bonds anytime.