Hello, and welcome back to Work in Progress. My name is Ben Williams with MG Surety Bonds, and this is our show dedicated to surety bonding and all things construction. Today we’re going back to the basics to talk about one of the most common types of contract surety bonds, which of course are bid bonds. Let’s get started.

What is a Bid Bond?

A bid bond is a three-party guarantee between a principal, an obligee and a surety. The principal is the contractor providing the bond. The obligee is the entity who the bond is running to. Now, this could be the federal government. It could also be an upstream contractor, such as a general contractor. The surety is the bond company making the guarantee. A bid bond’s primary guarantee is to protect the obligee by ensuring that if a contractor’s bid is selected, they will enter into a contract at that bid price and usually provide performance and payment bonds. In essence, it protects the obligee from the cost of another letting if the contractor chooses not to enter into that contract. As a secondary means, bid bonds are often used to prequalify subcontractors by ensuring that they’ve been reviewed by a third party, such as a surety company.

How Do Bid Bonds Work?

Bid bonds are normally expressed as a percentage of the contractor’s bid. Usually this is somewhere between five and 10%. Let’s look at an example. Let’s say our contractor bids $100,000 and has a 10% bid bond. The most the surety bond company would pay is $10,000 or 10%, but a bid bond guarantees the difference between the contractor’s bid and the next closest. Let’s say on that same bid, the second-place bidder bid $105,000. The most the bid bond would pay is $5,000. On the other hand, let’s say the second bidder was $120,000. Again,the most the surety would pay is $10,000 because that’s 10% and the penal sum.

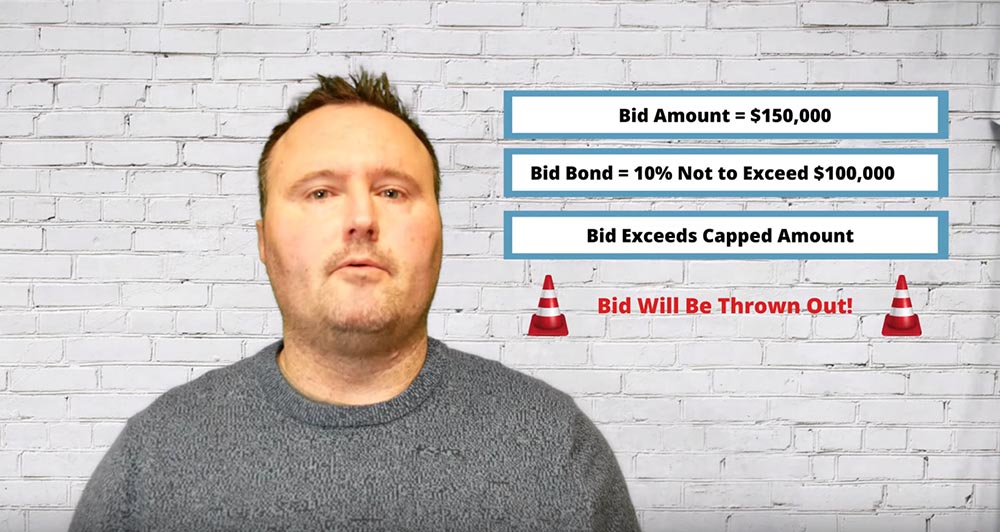

Although very rare, bid bonds can actually be “capped” by the surety. Why would a surety do this? Well, remember, a bid bond covers a percentage of the bid, so capping a bond prevents a contractor from bidding over the approved amount. Let’s say from our example earlier that instead of $100,000 our contractor bid $150,000. Well, the surety only approved $100,000, so they may cap the bid bond by saying 10%, not to exceed $100,000. In this situation, if the contractor turns in that bid bond in a $150,000 bid, that bid will then be thrown out because of the cap on the bid bond. Again, this is very rare.

Large Bid Spreads are An Issue

In reality, claims on bid bonds are very rare. Normally, if a bond company is going to support a contractor’s bid, they will then enter into performance and payment bonds to support that contractor. They don’t have to, however. Surety companies get very nervous when there’s a large bid spread. What that means is the difference between the first bidder and the second-place bidder exceeds 10%. If this happens to you, be ready to explain to your bond company why the project makes sense. If the bond company decides not to support the contractor, the contractor will have to look for another bond company to issue the performance and payment bonds. In the industry, this is called jumping a bid bond, and many bond companies simply won’t do it. Like all bid bonds, surety is a product of indemnity. That means that if a bond company decides not to support the bid, and we can’t find a replacement bond company, the bond company will then come and seek reimbursement from the construction company for any amounts that they’ve paid out.

Valid Defenses on Bid Bonds

Fortunately, there are some valid defenses for bid bond claims. It does depend on the contract, however. Usually, a valid defense involves a mathematical or a clerical error. Also, it’s best to let the obligee know right away what the mistake was. Bad judgment and bad estimating are not valid defenses for a bid bond claim.

What is a Good Bid Bond Company?

So what should a contractor and obligee look for in a good bid bond company? Well, first of all, if it’s a federal project, the bond company needs to be listed on the U.S. Treasury Department’s Circular 570. Secondly, it’s always a good idea to make sure that your bond company is rated A minus or better by AM Best or similar rating companies. Now, on some federal and private projects, there are exceptions where the contract will allow for an individual surety. Contractors should not make that mistake. That industry is filled with fraud, and often the contractor will have to pay the premium twice.

Alternatives to Bid Bonds

Now let’s talk about some alternatives to bid bonds. Most contracts will allow a contractor to post cash or an irrevocable letter of credit in lieu of a bid bond. However, there’s some strong reasons not to do that. First of all, you may need that cash or borrowing capacity. Secondly, how are you going to get a performance and payment bond if you’re awarded that project? But finally, and probably the most important reason, if there’s a problem or a claim, I can guarantee you that ILOC is gone. With a bid bond, the bond company is at least required to investigate and make sure it’s a valid claim.

Bid Bond Costs

Finally, let’s close with cost. Right now it’s a soft market and bid bonds are free from reputable brokers. We make our money off of performance and payment bonds and provide bid bonds as a service to our customers. Be wary of brokers that charge you for bid bonds.

We hope you found this episode helpful. Reach out to us anytime a www.MGSuretyBonds.com, and we’d love to answer your questions. Also, make sure you hit that subscribe button so you get all of our valuable content in the future. Also, remember, we’d love to hear suggestions for future shows in the comments section below. Thanks again for joining us. I’m Ben Williams with MG Surety Bonds, and this is Work in Progress. We’ll see you next time.