Are you looking for a way to increase your surety bond capacity? Surety Bond Capacity is the credit that a surety bond company extends to a Principal, both on a single project basis and as an aggregate limit. Increasing surety bond capacity is important to every company doing bonded work because it allows them to take on a larger work load. However, every Principal and Surety Bond company is a little bit different so increasing surety bond capacity is unique to each company. Below are some tips that can apply to most companies.

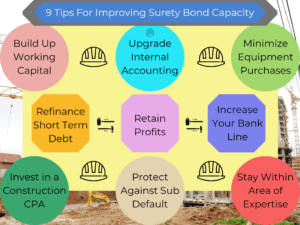

Build Up Working Capital

Most surety bond companies are working capital focused. That means working capital is the primary driver of bonding capacity. Therefore, increasing working capital will usually translate into more surety bond capacity. Remember, in construction, payment bond and performance bond claims often come when a contractor runs out of cash and working capital is a good measure of a contractor’s ability to meet current obligations. There are many ways to increase working capital. The best way is through profits but you can also be creative with debt. You can read more about working capital and that here.

Retain Your Profits

It an be tempting to distribute all the company profits at the end of the year. However, surety bond underwriters like to see that a company leaves at least some of its profits in the company to strengthen the balance sheet. This is especially true when the company is young and/or trying to grow with contractor marketing services. Having a history of leaving the profits in the company will be good sign to underwriters that you understand the importance of liquidity for your growing business. On the other hand, companies that regularly distribute all of their profits, often find themselves looking for a new bond company.

Avoid Unnecessary Equipment Purchases

Trucks and equipment are an important part of running a successful construction company. However, many companies get “iron fever”. New shiny equipment is fun and often a status symbol of a successful company. Low interest rates, and Section 179 tax deductions make it even easier to load on new equipment. However, there is a cost of this equipment. Interest payments have to be met, even if the work is not available. Bond companies look closely at a company’s profitability and this can be difficult with heavy depreciation expense. Make sure your equipment fits your company. Often, it may be better to rent a piece of equipment rather than be tied to it long term. If you do purchase equipment, consult with your surety bond expert before accelerating depreciation as this could have a tough impact on your bonding ability.

Upgrade Your Accounting Systems

I say this again and again but many surety bond claims are caused by contractors with poor internal controls. A contractor should know where the cash, costs and expenses are on all project at all times. It amazes me how many contractors have no idea where they sit financially and have to wait for an accountant to put this together for them. Make no mistake, your surety bond company knows a poor quality financial statement from a good one and they will limit your surety bond capacity accordingly. You can read more about appropriate financial statements for contract surety bonds here. At the very least, a contractor should have a system that can generate monthly reports with a work in progress schedule. These reports should correctly tie together and show accurate depreciation along with overbillings and underbillings.

Invest in CPA Statements

High quality CPA statements can be expensive. They are also required for contractors that want to keep growing their surety bond capacity. Surety Bonds are a credit product and these statements give the surety bond company assurances that your numbers are accurate. Small contractors can get away with less sophisticated financial statements. However, as a contractor grows, the scope of statement and expertise of their CPA needs to improve as well. In addition to surety bonds, this will also help contractors with their lender and other stakeholders as well.

Stay within Your Area of Expertise

Surety Bond companies are often willing to stretch bond capacity for contractors doing familiar work with familiar Owners. However, they often do not want to stretch on a project outside of a contractor’s expertise or geographical area. That means if your company normally builds schools a surety bond company will likely stretch to build a larger school project that makes sense. On the other hand, if you ask for a stretch to build a hospital, it may be met with some resistance.

Seek an Increase in Your BLOC (Business Line of Credit)

If you have an unused business line of credit, it can help increase your overall bonding capacity. Surety Bond underwriters view bank lines of credit as safety blanket and having more liquidity will also make them more comfortable extending your company more surety credit. This can be a double edge sword, however. Having and using a lot of your bank line may signal a cash problem and may actually hurt a contractor. Try to keep borrowings on your bank line to a minimum.

Refinance Short Term Debt

If you are with a working capital focused bond company, you can likely increase your surety bond capacity by refinancing short term debt and converting it to long term debt. In construction, this if often done by using equity in property or equipment and using it to convert short term bank debt into a term loan. Doing this will give up some flexibility but it will create working capital and bond capacity.

Protect Yourself From Subcontractor Risk

Problems with subcontractors and supplier can quickly derail a project. A bond company will be more comfortable stretching when they know you are protecting yourself from these risks. Pre-qualification, subcontractor bonds, contractor liability insurance and subcontractor default insurance are just a few ways to mitigate this risk.

If you want to increase your surety bond capacity, consider using the strategies found here. Every situation is different though. MG employs surety bond experts and we specialize in helping contractor increase their surety bond capacity. Contact us for more creative ways to help build your capacity.