Iowa Pharmacies who participate in wholesaling need to be licensed and provide a Wholesale Distributor License Bond to the State.

Who Needs an Iowa Pharmacy Wholesale Distributor License Bond?

Every wholesale distributor, wherever located, who engages in wholesale distribution into, out of, or within this state must be licensed by the board in accordance with the laws and regulations of Iowa before engaging in wholesale distribution of prescription drugs per Chapter 17 of the Iowa Pharmacy Code 657. The code also defines Wholesales Distributors in the following manner:

Wholesale distributor – “means anyone engaged in wholesale distribution of prescription drugs including, but not limited to, manufacturers; repackers; own-label distributors; private-label distributors; jobbers; brokers; warehouses, including manufacturers’ and distributors’ warehouses, chain drug warehouses, and wholesale drug warehouses; independent wholesale drug traders; reverse distributors; and pharmacies that conduct wholesale distributions exceeding 5 percent of gross annual sales of prescription drugs.”

Steps Required for Licensing

- Getting an Iowa Pharmacy Wholesale Distributor License requires several stepping including:

- An Application

- Evidence of current verified-accredited wholesale distributors (VAWD) accreditation by the National Association of Boards of Pharmacy

- A criminal background check

- Surety bond or equivalent security.

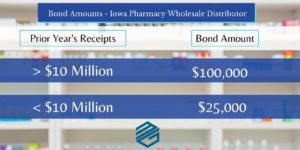

What is the Amount of the Iowa Pharmacy Wholesale Distributor License Bond?

The bond amount will be either $100,000 or $25,000 depending on the Wholesale Distributor’s Revenue. The code requirement says,

“The applicant shall file with the board a $100,000 surety bond or evidence that the wholesale distributor possesses the required bond in another state where the wholesale distribution facility does business. If a wholesale distributor’s annual gross receipts from the previous tax year were $10 million or less, the wholesale distributor need only file a $25,000 surety bond.”

Who Are the Parties to the Iowa Pharmacy Wholesale Distributor License Bond?

The Wholesale Distributor is the Principal on the bond. The Obligee is The Iowa Board of Pharmacy. The Surety is the bond company who is guaranteeing the Principal’s obligation.

What Does the Surety Bond Guarantee?

The Bond guarantees that the Principal will comply with all applicable laws and rules including Iowa Code chapters 124, 126, and 155A, and Iowa Board of Pharmacy and the Drug Supply Chain Security Act as included as Part II of the Federal Drug Quality and Security Act of 2013secure. The bond also guarantees payment of any administrative civil penalties, costs, or fees due to the IOWA BOARD OF PHARMACY that are not paid by PRINCIPAL within thirty (30) days after such administrative civil penalties, costs, or fees become final.

How to Get an Iowa Pharmacy Wholesale Distributor’s License Bond

Each surety bond company has their own underwriting requirements. Most will ask for a completed application. Some will also ask to see business financial statements on the Wholesale Distributor. Some may even ask for Personal Financial Statements from the owners of the Wholesale Distributor. MG Surety can issue these bonds for most wholesale distributors instantly by completing our online application below and having acceptable credit.

However, there are options for those with credit challenges as well. We work with most major bond companies to provide options for those in all circumstances.

What is the Bond Cost?

The cost of the bond is based on the credit and financial strength of the Principal. Most Wholesale Distributors can expect to pay about 2% per year for the bond. In other words, the $100,000 bond will usually cost $2,000 per year for most Principals. However, most bond companies will provide discounts for purchasing multiple years in advance. For example, a three-year bond can be obtained for $5,000.

How Long is this Bond in Place?

The Iowa Pharmacy Wholesale Distributor’s License Bond must be in place as long as the Wholesale Distributor maintains their license. The Surety can cancel the bond. If that happens, the bond will need to be replaced by another Surety to avoid a suspension. The Obligee can also make a claim on the bond up to one year after Principal ceases to be licensed.

Alternatives to a Surety Bond

Iowa will allow Wholesale Distributors to post in irrevocable standby letter of credit in lieu of a surety bond. This letter of credit must be in the same amount as the required surety bond. However, Wholesale Distributor should consider that letters of credit provide little defense against a claim. Additionally, they may tie up a company’s valuable borrowing capacity. More can be read about the differences between letters of credit and surety bonds here.

Indemnity Will Be Required

Wholesale Distributors looking to get an Iowa Pharmacy License Bond should know that these surety bonds require indemnity. That means that if the bond company pays a valid loss, they will seek to be reimbursed by the Principal and other indemnitors. This makes surety very different from insurance.

Iowa Pharmacy Wholesale Distributor License Bonds are required by the state to maintain licensing. They are affordable and can usually be purchased instantly. Wholesale Distributors may also need other Iowa Surety Bonds and many of those can also be purchase instantly here. MG Surety works with over 25 bond companies and we are surety experts. Contact us anytime with questions, or to discuss your bond needs.