Maryland Motor Vehicle Dealer Bonds

Maryland requires motor vehicle dealers to be licensed and to obtain Maryland Motor Vehicle Dealer Bonds. In fact, Title 15 302 of Maryland laws says,

“(a) A person may not conduct the business of a dealer unless the person is licensed by the Administration under this subtitle.”

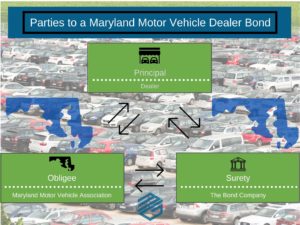

Who Are the Parties to the Maryland Motor Vehicle/Trailer Dealer Bond?

The motor vehicle dealer bond is a three-party agreement. The Dealer is the Principle on the Bond, the Obligee is the Maryland Motor Vehicle Association and the Surety is the bond company guaranteeing the obligation.

What is the Purpose of the Maryland Motor Vehicle Dealer Bond?

A Maryland Motor Vehicle Dealer Bond must be in place before after the state approves a Dealer’s license application but before the state issues the dealer a license. The Motor Vehicle Dealer Bond guarantees that the dealer will,

“conduct the business in full compliance with those Sections of the Transportation Article, of the Annotated Code of Maryland, as set forth in the Regulations of the Administrator of Motor Vehicles for the State of Maryland.”

Basically, the bond protects the state and individuals if the dealer does not comply with the state’s codes and laws. These laws include the following which are listed in Transportation Code 15-314 as follows:

(a) Misrepresentation. — A dealer or an agent or employee of a dealer may not misrepresent any material fact in obtaining a license.

(b) Conducting dealership under false name. — A dealer or an agent or employee of a dealer may not conduct a dealership in any name other than the one in which the dealer is licensed.

(c) Failure to notify of change of conditions. — A dealer or an agent or employee of a dealer may not willfully fail to notify the Administration of any change of ownership, management, business name, or location or of the employment of vehicle salesmen, as required by this title.

(d) Doing business with unlicensed persons. — A dealer or an agent or employee of a dealer may not do any vehicle sales business with or through any person required to be licensed under this title if he knows that the person is not licensed.

(e) Selling certain vehicles without license. — A dealer or an agent or employee of a dealer may not sell any new motor vehicle, or new two-stage motor vehicle unless the manufacturer or distributor of the vehicle is licensed as required by this title.

(f) Failure to comply with rules, regulations, or orders. — A dealer or an agent or employee of a dealer may not willfully fail to comply with any rule, regulation, or lawful order adopted by the Administration under this title.

(g) Violations of dealer licensing laws. — A dealer or an agent or employee of a dealer may not willfully violate any of the dealer licensing laws of this State.

Amount of Maryland Motor Vehicle Dealer Bonds

The amount of the Maryland Motor Vehicle and Trailer Dealer Bond depends on the number of vehicles and whether those vehicles are new or used vehicles.

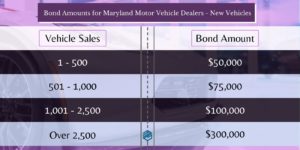

New Vehicle Dealer Maryland Bond Amounts

These bond amounts are for New Vehicle Dealers only and are based on the number of new motor vehicle sales during the preceding license year:

1 to 500 vehicles – $50,000 Surety Bond

501 to 1,000 vehicles – $75,000 Surety Bond

1,001 to 2,500 vehicles – $100,000 Surety Bond

Over 2,500 vehicles – $300,000 Surety Bond

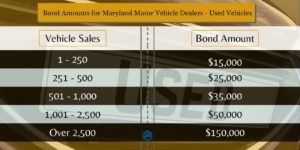

Used Vehicle Dealer Maryland Bond Amounts

These bond amounts are for Used Vehicle Dealers only including Wholesalers and are based on the number of used motor vehicle sales during the preceding license year:

1 to 250 vehicles – $15,000 Surety Bond

251 to 500 vehicles – $25,000 Surety Bond

501 to 1,000 vehicles – $35,000 Surety Bond

1,001 to 2,500 vehicles – $50,000 Surety Bond

Over 2,500 vehicles – $150,000 Surety Bond

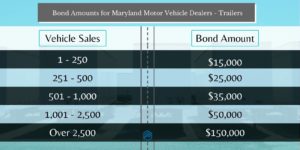

Trailers and Semi-Trailer Dealer Maryland Bond Amounts

These bond amounts are for Trailer Dealers only including Wholesalers which sell trailers over 15” in length and are based on the number of trailer sales during the preceding license year:

1 to 250 vehicles – $15,000 Surety Bond

251 to 500 vehicles – $25,000 Surety Bond

501 to 1,000 vehicles – $35,000 Surety Bond

1,001 to 2,500 vehicles – $50,000 Surety Bond

Over 2,500 vehicles – $150,000 Surety Bond

Small Trailer Dealer Maryland Bond Amounts

A Dealer that is only dealing in boat trailers or other trailers and semi-trailers of 15 feet or less is only required to obtain a $5,000 Surety Bond for the state.

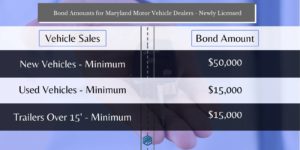

Newly Licensed Dealer Maryland Bond Amounts

If the Dealer is newly licensed and does not have previous sales, the state of Maryland will use an estimate of future vehicles sales to determine the bond amount. However, the minimum bond amounts are:

New Vehicle Dealer – $50,000 Surety Bond

Used Vehicle Dealer – $15,000 Surety Bond

Trailers or Semi-Trailer Dealer over 15 Feet – $15,000 Surety Bond

What is the Cost of a Maryland Motor Vehicle Dealer Bond?

The cost for these bonds is determined by the credit and financial strength of the Dealer. Most dealers can expect to pay about 1% per year for every year that the bond is in force. Keep in mind that these surety bonds are continuous, and the premium will be do every year that the license in in place. Most surety bond companies provide a premium discount for dealers who purchase multiple years up front. These discounts can range between 10% – 30% depending on the surety bond company and the length of time purchased.

Those dealers with credit challenges can still obtain these surety bonds. However, the cost may be slightly more.

Length of the Dealer Bond

The bond is continuous. That means that the bond needs to remain in place and be renewed as long as the dealer maintains the licensing. However, the bond does not stack liability. That means that surety bond company’s liability is not increased with each year’s renewal.

Cancellation

The Maryland Motor Vehicle Dealer Bond can be cancelled by the Surety by giving forty-five (45) days written notice to the Administrator of Motor Vehicles, State of Maryland. It must be sent either certified or register mail. The Surety is still responsible for the liability under the bond until the 45-day period has passed. If the bond is cancelled, the dealer needs to provide the state with a replacement bond from another surety before the cancellation period is over or risk having their license suspended.

Claims Against the Bond

Claims can be made against the bond by either the state or any individual who has been affected by the Dealer not complying with the state’s laws and regulations. The Surety will investigate the claim to see if it has merit before paying the claimant.

Indemnity is Required

Like most surety bonds, Maryland Motor Vehicle Dealer Bonds require indemnity. These bonds are not insurance and the surety bond company will seek reimbursement from the Dealer and any other indemnitors if they must pay a valid loss. You can read more about indemnity here.

Maryland Motor Vehicle Dealer Bonds are a requirement to do business in the state of Maryland. These bonds are easily obtainable for most dealers. Some of them can be issued instantly along with other types of surety bonds by visiting our Maryland Surety Bond page here. Contact us anytime with questions on these bonds or any surety needs. You can also learn more by visiting our FAQ Page on Surety Bonds or our Bond Blog for educational material.