Under Medicare, an Accountable Care Organization (ACO) needs a repayment mechanism such as a surety bond. Accountable Care Organizations are groups of hospitals, doctors, medical suppliers, and other healthcare providers that come together to give high quality health care to Medicare patients. According to the Centers for Medicare and Medicaid Services, when an ACO succeeds both in delivering high-quality care and spending health care dollars more wisely, the ACO will share in the savings it achieves for the Medicare program. However, in some ACOs, the opposite could also be true. The ACO could be responsible for additional costs to the Medicare program. ACOs can be complex and beyond our scope of expertise. More information can be found on the CMS.GOV website. Instead, this article focuses on the required Repayment Mechanisms for ACOs, including surety bonds.

Repayment Mechanism Requirement

The Medicare Shared Saving Program allows ACOs to share in the potential risk and rewards of better health outcomes. You can see the different paths here. However, the CMS wants to make sure that the ACO can be financially responsible if there are losses in the program. Therefore, one of the program’s requirements is,

“ACOs must establish a repayment mechanism to assure CMS that they can repay losses for which they may be liable upon reconciliation for each performance year under which they accept performance-based risk.”

What is the Required Amount for the Repayment Mechanism?

Per the CMS Guidance Document, the Repayment Mechanism must be the lesser of:

- One percent of the total per capita Medicare Parts A and B fee-for-service (FFS) expenditures for its assigned beneficiaries, based on expenditures for the most recent calendar year for which 12 months of data are available; or •

- Two percent of the total Medicare Parts A and B FFS revenue of its ACO participants, based on revenue for the most recent calendar year for which 12 months of data are available.

ACOs should note that shared losses could exceed these amounts and the ACO will be responsible for any portion of their loss not covered by the Repayment Mechanism.

What Are Acceptable Forms of Repayment Mechanism?

An ACO in a two-sided model has a few options for providing a Repayment Mechanism. These include the following:

- A Surety Bond

- A Letter of Credit

- Escrow

A Surety Bond

According to the CMS, a Surety Bond can be used as a form of repayment security so long as it meets certain conditions. Per the CMS Guidance Document, these are as follows:

- A statement naming the ACO as the Principal, CMS as the Obligee, the insurance company as Surety and including a statement that the Principal and Surety bind themselves, their heirs, executors, administrators, successors, and assignees, jointly and severally, by these presents. This is standard for a surety bonds and most General Indemnity Agreements between the Surety Bond Company and Principals will contain similar language.

- The surety’s name, street address or post office box number, city, state, and ZIP code on the surety bond should be identical to the surety’s legal entity name and address as listed on the U.S. Department of the Treasury’s List of Certified (Surety Bond) Companies.

- The appropriate surety bond amount is specified and aligns with the required final repayment mechanism amount.

- A statement that the surety is liable under the bond for only the shared losses determined by CMS to be owed by the ACO for the performance year(s) under a two-sided model covered by the ACO’s participation agreement and CMS may collect on the bond up to amount of the bond (penal sum). Medicare Shared Savings Program | Repayment Mechanism Arrangements Guidance 14

- A statement that the surety agrees to pay the shared losses within 30 days of receiving written notice of the shared losses from CMS demonstrating that the ACO has failed to pay the shared losses in full. This is different from many surety bonds. The surety bond company will need to be familiar with such a term as they have a responsibility to quickly investigate and settle a claim.

- A statement that the surety agrees to not contest the amount owed as reflected in the documents provided by CMS to the ACO.

- A statement that the surety is liable for assessments that occur during the term of the bond.

- Assurance that the surety will notify CMS promptly in writing if there is a lapse in the surety bond coverage or a change in the amount of the bond.

- A statement that the surety will notify CMS at least 90 days in advance of cancellation or termination of the bond.

- A statement that the surety will remain liable for any and all indebtedness of the Principal to the Obligee which accrued prior to the effective date of cancellation or termination of the bond.

Other than points number 5 and 6, these items are standard. Surety Bond Companies writing these ACO Performance Bonds understand the risks of those points before issuing these bonds.

Treasury Listing Required

Another requirement of the surety bond is that the surety bond company be listed on U.S. Treasury 570 Circular. We always feel like this is a good idea. However, it is an important step to verify this, especially by ACO’s who may not have experience with surety bonds. You can read more about verifying a bond here.

Term of the Surety Bond

The term of the surety bond required by the CMS can be either:

- The full duration of the ACO’s participation plus an additional twelve months, OR

- The first two performance years of the ACO’s participation plus automatic twelve-month extensions for the remainder of the ACO’s participation plus twelve additional months.

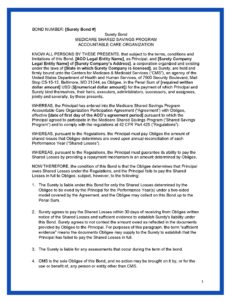

Surety Bond Companies will prefer option number two. Generally, bond companies do not like long term obligations but the extensions along with the 90-day cancellation provisions, make these attractive bonds for the surety company to write. Below is a copy of an acceptable surety bond form provided by the CMS and also reference as Appendix D under their Repayment Mechanism Guidance.

Irrevocable Letter of Credit

The CMS will also accept a letter of credit as a Repayment Mechanism. Per the CMS Guidelines, the letter of credit must meet the following requirements:

- The institution establishing the letter of credit is insured.

- The letter of credit is irrevocable.

- CMS is designated as the sole beneficiary.

- The appropriate credit amount is specified and aligns with the required final repayment mechanism amount.

- The terms allow CMS to demand payment for an amount available under the letter of credit upon presentation to the issuing institution of a dated statement signed by an authorized signatory of CMS on CMS’s letterhead that includes the following information: Standby Letter of Credit Number; issuance date of the letter of credit; issuing institution name; the amount demanded by the Beneficiary (CMS) from the letter of credit Applicant (ACO) as provided under the Medicare Shared Savings Program regulations at 42 CFR Part 425; and the method of payment to the Beneficiary. This demand is accompanied by the following: the original letter of credit and all amendments thereto, if any; and a copy of the written notice from the Beneficiary to the Applicant of the amount owed. Note: CMS will consider terms that provide for electronic presentation and the circumstances for electronic presentation.

- Partial or multiple drawings are allowed.

- All of the issuing institution’s charges and fees are paid by the ACO and shall not be deducted from any payment the issuing institution makes to CMS under the Letter of Credit.

The same terms and automatic extensions apply to the Irrevocable Letter of Credit. Although the CMS accepts an irrevocable letter of credit, that does not mean it is the best option for an ACO. Consider that letters of credit with tie up the ACO’s borrowing ability and liquidity for the entire agreement. The ACO may need this borrowing ability. Letters of credit may also need to be secured with cash or other assets and the ACO could lose the potential growth on these assets. Also, there is far less volatility with surety bonds than debt instruments. Interest rates and fees and the overall lending environment may have a significant impact on renewals. You can read more about the differences between surety bonds and letters of credit here.

Escrow

The CMS will also allow an ACO to place funds into escrow as a repayment mechanism. Again, per their guidelines the following is required:

- The institution is insured.

- Funds are invested in a money market account, such as in treasury backed securities, mutual funds, or both. An interest-bearing money market deposit account may be used.

- The instructions for disbursement of the assets, escrow termination and asset replenishment are consistent with CMS’ standard escrow instructions (refer to Appendix A, Section 10).

- The costs, fees, and expenses associated with the escrow account, including any legal expenses incurred by the escrow agent or the ACO, are not borne by CMS, and such costs are not charged to the principal.

- The principal cannot be encumbered for any purpose other than repaying shared losses owed by the ACO to CMS. Medicare Shared Savings Program | Repayment Mechanism Arrangements Guidance 11

- CMS is not required to indemnify any person or entity against any loss, claim, damages, liabilities, or expenses, including the cost of litigation arising from the escrow agreement or the subject of the agreement.

- CMS will receive advance notice of any change in the amount of funds held in escrow.

- The escrow account is fully funded up to the final repayment mechanism amount by the date specified by CMS.

Escrow is usually the least preferred Repayment Mechanism by ACOs. Having to fully fund the potential losses for the period of participation means that cash cannot be used for other purposes. We believe a surety bond is a superior choice as it allows the ACO to continue to use their assets for growth and other business purposes.

The Medicare Shared Savings Program may present an excellent opportunity for Accountable Care Organizations to improve health outcomes and share in cost savings. We believe surety bonds may be the best Repayment Mechanism for many ACOs as they are cost effective, and typically do not tie up valuable resources. Contact our surety bond experts to learn more.