Welcome back to Work in Progress. I’m Ben Williams with MG Surety Bonds and this is our show dedicated to surety bonding and all things construction. Today we’re continuing to talk about the basics and we’re going to tell you everything you need to know about a performance bond, stay tuned.

Performance Bonds are Required on Federal Projects

So why are you being asked for a performance bond? Well like we said on bid bonds, any federal project $150,000 and up is required to have a performance bond. Many states have adopted similar legislation, and many private owners and even some commercial and remodeling contractors also require them to reduce their risk.

What is a Performance Bond?

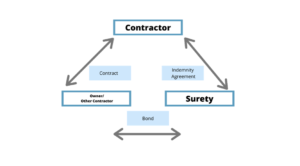

A performance bond is a three-party guarantee between a surety, an obligee and a principal. The surety is the bond company guaranteeing the obligation. The obligee is who is benefiting from the bond such as an owner or an upstream contractor. And the principal is the contractor providing the bond. Now a performance bond guarantees that a contractor is going to complete a project according to the contract and bond form. They are almost always written for 100% of the contract amount, meaning that if your contract is $100,000, your performance bond will also be for $100,000. It can be written by itself, but usually, it’s accompanied by a payment bond and sometimes even a maintenance bond.

How Do You Get One?

So how do you get a performance bond? Well if the contract amount is $500,000 or less, it’s very easy. Usually, a contractor can fill out a one-page application, we’ll run the personal credit on the owners and if they’re acceptable, the contractor can get a performance bond right away. For larger or more complicated projects, a contractor must go through full surety underwriting, referred to as the three Cs.

Performance Bond Claims

Performance bond claims are rare, but they shouldn’t be taken lightly. Typically, a claim will take a contractor out of business. Now like all surety bonds, performance bonds are written on the principle of indemnity. That means if the bond company suffers a loss, that they will come back to the construction company and personal indemnitors to seek reimbursement.

Performance Bond Costs

So, what do they cost? Well, that depends on a couple of things. One, the class of business and two the strength of the contractor. Obviously the stronger a contractor, the lower the rate. The more risk to the bond company, the higher the rate. Typically, this scale is anywhere from less than 0.5% of the contract all the way up to about 3%. Now keep in mind most contractors are on a sliding scale. That means that as the project gets bigger, the bond rate gets smaller. Also, they are usually written with a payment bond. If that’s the case, you’re only charged for one and not both.

Verify the Surety Bond Company

We always advise contractors and obligees both to look for certain things in a performance bond company. Again, if it’s a federal project that bond company needs to be listed on the US Treasury Department’s 570 Circular. Also, it’s always a good idea to check out the rating of your bond company. AM Best is a great service and your bond company should be rated at least A-minus or better. As we’ve said in the past, avoid individual sureties, as fraud is rampant.

We hope you found this information useful. Make sure you hit that subscribe button so that you get all our future content, and we’d always love to hear from you in our comments below. Remember you can always reach us at www.mgsuretybonds.com. Contact us today. I’m Ben Williams, this is Work in Progress, we’ll see you next time.