A Release of Mechanic’s Lien Bond can be an effective tool for Project Owners and Contractors alike. They can also be confusing and misunderstood by all parties. In this article, you can learn what you these surety bonds cover and how to get one.

A mechanic’s lien is a valuable tool for contractors and material suppliers to get paid on private projects. If one of these parties is not paid for work performed or material supplied on a project, they can attach a mechanic’s lien to that project. Due to The Miller Act, contractors are unable to attach a mechanic’s lien to Federal projects and most public projects. A mechanic prevents the project owner from being able to sell the property until the mechanic’s lien is satisfied. Often, loan covenants, construction contracts, and other documents require a property to be lien free. In these instances, owners or contractors may be required to discharge the lien from the property immediately. If the mechanic’s lien is in dispute, a Release of Mechanic’s Lien Bond can be posted to free the lien from the property until the dispute is settled. This is also known in the industry as bonding around a lien.

What is a Release of Mechanic’s Lien Surety Bond?

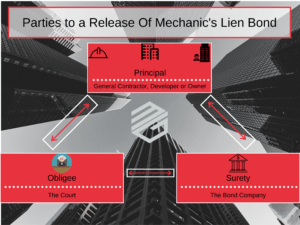

A Release of Mechanic’s Lien Bond is a type of surety bond that clears the mechanic’s lien from the property. These bonds can also be called a Discharge of Mechanic’s Lien Bond. By clearing the lien, the owner is free to sell or use the property for other purposes. The bond guarantees the filing contractor’s rights under the mechanic’s lien until the matter is settled. Either the contractor will receive their payment with interest, the matter will be settled, or the lien will be thrown out by a court of law. The Principal on the bond is usually the property owner or general contractor. The obligee is the court and the surety is the bond company.

What is the Amount of the Bond?

Each state has their own requirements regarding Release of Mechanic’s Lien Bonds and what amount needs to be filed. Generally, they are more than 100% of the mechanic’s lien amount. These can range from 110% to 200% of the mechanic’s lien amount depending on the state.

How to Get a Release of Mechanic’s Lien Bond

Getting a Release of Mechanic’s Lien Bond can be tricky. For General Contractors, surety bond companies write these bonds freely so long as the contractor has a good track record with the surety bond company and that they have the balance sheet to pay for the mechanic’s lien if it is found to be valid. On the other, hand, developers, and property owners may find that these bonds are more difficult to obtain. A surety bond company may even request collateral for a property owner or developer depending on the circumstances. All parties requesting a Release of Mechanic’s Lien Bond will likely need to submit both company financial statements and personal financial statements to the surety bond company for underwriting. Additionally, the surety bond company will want a copy of the court paperwork and an explanation of the mechanic’s liens from the Principal. The stronger a party’s financial strength compared to the surety bond amount, the easier the bond will be to get.

Claims on Release of Mechanic’s Lien Bonds

If a court rules against a General Contractor, Owner or Developer regarding the mechanic’s lien, the company will likely have to pay the lien amount plus accrued interest. If they cannot or do not pay the amount, the surety bond company will have to step in and pay the claim. Once this happens, the surety bond company will seek reimbursement from the Principal on the bond along with any indemnitors under the Principle of Indemnity. Case law also states that a claim may be made directly against the surety bond company without bringing suit against the Principal. This was decided by the Washington State Supreme Court in the case of Inland Empire Drywall Supply Company vs. Western Surety Company.

What Do These Bonds Cost?

Costs for these bonds depends on the financial strength of the Principal and the surety bond company. However, these bonds are considered higher risk, and many surety bond companies charge a flat rate such as 2.5%. In general, 1.5% to 3% will be the rate for most Release of Mechanic’s Lien Bonds.

Homeowners and Release of Mechanics Lien Bonds

Though much of our discussion involves commercial properties, residential homeowners often need this type of surety bond as well. This happens when residential contractor files a mechanic’s lien against the homeowner’s property. Although these disputed amounts may be smaller, the bond requirements are the same. In consideration for these bonds, most surety bond companies usually want 100% collateral before writing Release of Mechanic’s Lien Bonds for homeowners. Of course, there are exceptions to that rule.

Mechanic Lien laws and Release of Mechanic’s Lien Bonds can be complicated. Because each state has its own requirements, contractors should seek a surety bond expert and construction attorney who are familiar with the laws in that states. Contact MG Surety Bonds and our surety experts anytime to get the best advice for your situation.