With surety bonds, collateral is typically used for protecting the surety bond company from a possible loss. Here, you can learn about the collateral used for surety bonds, along with some pros and cons of each.

Keep in mind, while there are thousands of surety bond types, the most common include court bonds, licensing bonds, and construction bonds. Each one has unique characteristics regarding the collateral requirements. There are some bonds that require full collateral, but most allow some discretion regarding collateral, when it is used and how much is required.

Conventional Surety Bond Collateral

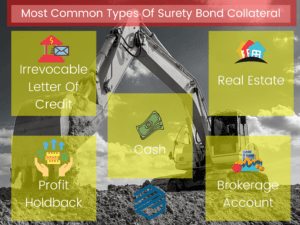

Some of the most common types of surety bond collateral are listed below.

ILOC – Irrevocable Letter of Credit

ILOCs are the most common type of collateral taken by a surety bond company. You can read more about the difference between ILOCs and surety bonds here. ILOCs are a written guarantee by a financial institution that can be drawn on demand. The financial institution issues the letter in favor of the surety bond company. The amount of ILOC required by the surety bond company can vary, but usually it is set anywhere from 5% of the bond amount all the way to 100% of the bond amount.

From the point of view of the surety bond company, the ILOC is a trusted source of collateral and is easily convertible to cash if needed. Unlike other forms of collateral, the surety bond company does not need to do anything other than draw on the ILOC to receive funds. For this reason, it is the surety bond company’s preferred method of collateral.

ILOCs can be problematic for the Principal. If a surety bond company is requesting collateral, it is often because the Principal does not have the financial resources to qualify without it. However, to receive an ILOC from a lender, the borrower will usually have to fully collateralize the lender with hard assets or receivables in order to qualify for an ILOC. Therefore, a Principal may be in a tough situation of trying to find resources to satisfy both the surety and the lender.

Cash Collateral

Cash collateral is another common type of collateral used for surety bonds. Usually, the principal will wire transfer funds from their bank account to the collateral account held by the surety bond company. In other cases, the customer writes a cashier’s check to the company providing the surety bond.

One downside of using cash for collateral is that customers lose the “opportunity cost” of using the funds for another purpose.

Often, if collateral is required, they need the use of their cash. The biggest benefit of cash collateral is that it’s simple and fast to understand by all the parties involved. Cash is also the most secure type of collateral used.

Real Estate

Some surety bond companies will allow the use of real estate as collateral. To do this, the surety bond company must do a title search to make sure there are no liens against the property. The surety bond company will then make a UCC filing to perfect their interests on the real estate until the bond is finished. After the project is completed or the surety bond is released, the surety bond company will release the real estate collateral.

There are some risks associated as using real estate for collateral purposes. For example, who is the true owner of the property? What’s the property’s value? How much equity is in the property being used? Is the property part of a trust?

There are some great benefits of real estate however. For one, it does not drain the company’s cash and banking resources. It is also cost effective if it is free of debt. Finally, it can be done quickly and easily without the involvement of other parties.

Profit Holdback

In some scenarios, the surety bond company will hold back a portion of the project’s profit as collateral. This form of collateral is normally used in combination with Funds Control. The advantage to this method is that a Principal does not have to come up with the collateral before starting the project. Instead, a portion of the profit is “held back” by the surety bond company from each pay request until the total reaches the specified amount.

Profit holdback is a big advantage to the Principal but it comes with risk to the surety bond company. If the job is not estimated properly, or if there is a problem, the surety bond company may not be left with any collateral to hold. Normally profit hold back works for projects and trades that have significant gross profit in the project.

Brokerage Accounts

Some surety bond companies will accept a collateral position on a brokerage account. The benefit to the Principal is that they can earn interest on the funds being used as collateral instead of it being a cost such as with an ILOC. Usually, the surety bond company will require the funds to be invested in money market accounts though so that the risk of loss is minimal. Also, the surety bond companies that allow this almost always require the Principal to move the funds into a new joint brokerage account at a brokerage of their choosing. This requires some time and will usually be met with some pushback from their current brokerage firm.

At MG Surety Bonds, we try to find alternatives to collateral. Collateral tends to cost money and can tie up valuable resources for the Principals. At times, it may be required but we work with Principals to find the best terms to support their unique circumstances.

To speak with a surety bond expert, contact MG Surety today!