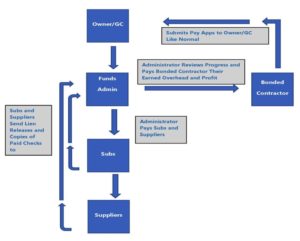

Funds control is a term used in surety bonding and can also be called funds administration or just escrow. It usually involves a third party handling the contract proceeds to process payments for bonded contractor. The idea is very similar to a construction loan on the residential side. The process typically looks something like this:

When necessary, funds control is specified by the surety bond company as a condition of approval. The funds control company or administrator is typically a different company than the surety bond company. The contractor has a normal General Indemnity Agreement with the surety bond company, and they will have to sign a separate agreement with the funds control company. This document outlines how the contractor will submit draw requests, along with when and how the funds will be paid. The obligee (who the bond runs to) will most likely have to sign a disbursement document as well. Most funds control companies will have a new bank account set up in the contractor’s name to handle payments.

When Is It Used?

A surety bond company can ask for this tool anytime. However, it is normally used when a contractor is having financial difficulties, are stretching on a single project or are stretching on backlog. It could also be used when a contractor is performing work in a new geographical area, or a scope of work outside of their normal expertise.

Why Is It Used?

Funds control helps protect the surety bond company by ensuring that the contract proceeds on a given project are used for that project. It keeps a contractor from robbing one project to fund another. The contract can still use the earned profits to fund his/her operation and other projects. Often, contractors fail when they run out of cash. This tends to be a domino effect as one bad project can rob cash from what would otherwise be good projects. This tool helps alleviate this risk for the surety bond company.

In theory, even if all the contractor’s other projects go bad, the contractor and their surety bond company have enough contract proceeds to complete the bonded job. This of course assumes that the project was bid adequately, but more on that later.

It also protects the surety bond company from payment bond claims of subcontractors and suppliers. In a typical funds control arrangement, subcontractors and suppliers are paid directly by the funds control company and the funds control company obtains lien waivers. An added benefit is that this also protects the owner or upstream contractor and their surety bond company.

What’s the Downside?

Loss of Control – Change is hard for everyone and the biggest complaint will be that this is a different process. The contractor loses control of project funding when funds control is required. If a contractor is in the habit of significantly overbilling their projects, they will not like funds control. Usually a contractor is only able to get their earned overhead and profit with some slight overbillings. Therefore, if a contractor likes to overbill or job borrow, this tool will be a frustration.

There Is a Financial Cost – Remember, a funds control company is usually a separate company from both your surety bond company and your bond broker. Therefore, they want to get paid for their work as well. The cost of funds control is dictated by the funds control company and typically ranges between 0.5% – 1% of the contract amount. Contractors will have to factor this into their job cost or take it out of their profits.

Obligee Involvement – Unlike other tools at the surety bond company’s disposal such as SBA support, collateral, etc., funds control will require the obligee knowing that the contractor is using it. Because the obligee will be required to submit the contract proceeds in the new shared bank account, they will have to sign paperwork acknowledging the arrangement and agreeing to do so. Unfortunately, many contractors are embarrassed to ask the obligee and feel that it may hurt their ability to do more work in the future. The truth is that most obligees have never heard of, or used funds control and will not be familiar with it. I find that once they are, they like it. Ultimately, obligees are asking for performance bonds and payment bonds to protect themselves against problems on their project. By helping contractors with their project accounting and vendor payments, funds control helps accomplish what the obligee is trying to do anyway.

What’s the Upside?

Getting Surety Bonds – Like most specialty tools, funds control is a tool of last resort to help get a surety bond. At MG Surety, we do not like to use this unless tool until we have exhausted all options. Therefore, it can be a way to help a contractor get a surety bond or stretch their bond capacity when all else fails.

Helps Newer or Smaller Contractors with the Back Office – Smaller contractors may like funds control because it takes care of important administrative tasks that they may not have the staff or time to complete. Project accounting, cash management and lien waivers are vital, but many do not have the staff to do it adequately.

Better Than the Alternatives – Again, funds control should be a tool of last resort for most companies. As such, some surety bond companies may ask for collateral such as cash or a bank letter of credit. I prefer funds control to these methods because they do not tie up a contractor’s cash like those methods. As we have said many times, contractors often fail when they run out of cash or liquidity. That means that those methods may protect the surety bond company, but they may further burden the contractor by tying up their cash or borrowing capabilities.i

Hopefully you have a better understanding of the funds control process. Funds control can be a helpful tool for contractors trying to secure bonding or additional surety bond capacity. It is not for everyone though and there are other ways to boost your surety bond capacity. It is important to make sure all parties understand the process and commitments before moving forward. At MG we will work to find the best option for each of our contractors and we normally only use funds control as a last resort. Contact us today!