It may surprise some that the surety bond market cycle does not follow the general economy exactly. It is important for contractors and all users of surety bonds to understand how the cycle works and what could happen to the surety bond marketplace in the future.

Competitive Surety Market Conditions

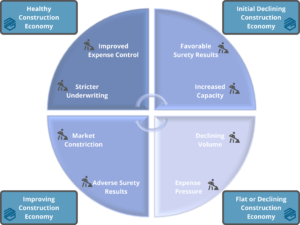

The chart below shows the market cycle for surety bonds. As you can see surety bond results trail the overall construction economy. A healthy construction economy produces “soft” market conditions. This is because surety losses are low, and profits are high. Profitable results cause more companies to want to write surety business. Existing surety bond companies look to increase their market share while new companies enter the market. This competition leads to more surety capacity in the marketplace. It also eases underwriting standards and reduces rates. We have been in a very “soft” surety market for some time. Historically, these conditions continue even after a downturn in the construction economy.

Declining Surety Market Conditions

At some point the decreasing or flat construction economy causes pain for contractors. Forced to operate on lower volume, they must cut overhead and/or become less profitable or lose money. The same can be said of surety bond companies. Flat or declining project opportunities means less bonds to be written. This creates flat or decreasing surety bond premium. The only way for a surety bond company to maintain profits is to cut expenses. This creates pressure for lower losses, higher rates, less commission, etc. During this period, we see a “hardening” of the surety bond market. Still, this is not when we normally see a lot of performance and payment bond claims.

Difficult Surety Market Conditions

Once the construction economy picks back up, contractors will look to grow and take on more work. However, their resources are often much smaller after going through a downturn. They may have had to let key people go, sold equipment, increased debt or used their cash reserves. This can all make it difficult to take on a larger workload. Often, contractors run out of cash or get overextended during this period and this is when the contract surety bond industry typically sees most of their losses. As losses increase for both surety bond companies and their reinsurance companies, some will decide to get out of the surety business completely. Others may decide to scale back or toughen underwriting requirements. These things lead to what we would call a “hard” surety market. Contractors may find contract surety bonds more difficult to get during a hard market. Surety bond companies may require stronger company financial statements, higher rates, and more restrictive terms.

COVID-19 has presented a unique situation for construction and the surety bond industry. Before the pandemic, the construction market was fairly strong, and most contractors had good backlogs. However, the current economic data is very weak. The pandemic has taken a toll on the private sector and has strained public budgets. The effect on construction and surety bond industry will likely depend on how private investments rebound as well as the passing of a long discussed infrastructure bill. Without these things, we may start to see contractor backlog suffer and that would negatively impact contractors and their resources. This could in turn lead to surety losses and hardening market conditions.

We have been on a long run of a favorable surety bond market. We hope this continues and construction economy bounces back quickly. Regardless, contractors should prepare their companies and balance sheets for changing market conditions.