Indiana Vehicle Merchandising Bond – New and Used Vehicles

Vehicle Dealers in the State of Indiana need to obtain a Dealer’s license from the state and an Indiana Vehicle Merchandising Bond.

Who Needs to Be Licensed and Bonded?

New Dealer License

You must obtain a New Dealer License if you sell, offer to sell, advertise twelve (12) new motor vehicles (includes off-road vehicles, snowmobiles, and mini-trucks); or three (3) new manufactured homes in a twelve month period.

Used Dealer License

You must obtain a Used Dealer License if you sell, offer to sell, or advertise for sale at least twelve (12) used motor vehicles (includes off-road vehicles, snowmobiles, and mini-trucks) or three (3) used manufactured homes in a twelve month period.

You can learn more about new and used vehicle licensing requirements here.

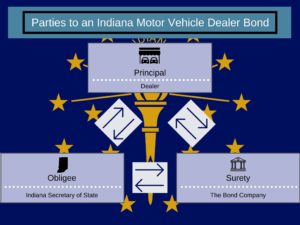

Who Are the Parties to an Indiana Vehicle Merchandising Bond?

These surety bonds are a three-party guarantee. The Motor Vehicle Dealer is the Principal on the bond. The Obligee is the party requiring the bond and who gets the direct benefit of the guarantee. On this bond, the Obligee is The Indiana Secretary of State Auto Vehicle Services Division. The Surety is the bond company who is guaranteeing the obligation of the bond.

What Does the Indiana Vehicle Merchandising Bond Guarantee?

The surety bond guarantees that the Dealer will comply with all laws, ordinances and resolutions that govern the issuance of the Motor Vehicle Dealer License issued by the Indiana Secretary of State. You can read more about these responsibilities here. A person may file a claim against the Dealer for violating the provisions. The State requires that notice be given, an opportunity for a hearing and an opportunity for judicial review. The bond secures damages for a person who is affected by a violation of the dealer after a judgement has been issued. The bond also helps secure payment of fines, penalties, costs, and fees assessed by the Secretary of State.

What is the Amount of the Indiana Vehicle Merchandising Bond?

The State of Indiana requires that both New Vehicle Dealers and Used Vehicle Dealers maintain a surety bond in the amount of $25,000.

How Do You Obtain an Indiana Vehicle Merchandising Bond?

These bonds are very easy to obtain and can be purchased instantly below by most dealers. Most surety bond companies do require a credit check for these bonds. MG Surety works with 25+ bond companies and can help dealers of all circumstances. We even have options for those with credit challenges.

What is the Cost of an Indiana Motor Vehicle Dealer Bond?

Many surety bond companies charge 1% or $250 per year for these bonds. We do work with bonds companies with even better pricing, but you must call and qualify for preferred pricing.

Length of the Bond

The Indiana Vehicle Merchandising Bond is continuous for as long as the Dealer is licensed. That means the bond will need to be renewed each year. That also means that the bond premium will be due each year that the bond is in force.

Cancellation of the Bond

The Surety may cancel the bond by giving thirty days written notice to the Obligee and the Principal. The notice of termination does not become effective until the Secretary of State receives the notice at their office which is currently:

302 West Washington Street

Room E-111

Indianapolis, IN 46204

The Surety is still liable for actions violations committed while the bond was in existence and during the thirty-day notice period. If the Surety cancels the bond for any reason, the Dealer will need to secure a replacement bond from another surety bond company or risk having their license suspended.

Indemnity is Required

Like most surety bonds, Indiana Vehicle Merchandising Bonds require indemnity. These bonds are not insurance and the surety bond company will seek reimbursement from the Dealer and any other indemnitors if they must pay a valid loss. You can read more about indemnity here.

Indiana Vehicle Merchandising Bonds are required by the State. Fortunately, these surety bonds are easily obtainable for most dealers and can be purchased instantly. Dealers may also need other Indiana Surety Bonds. Many of those can also be purchased directly here. Contact MG Surety Bonds anytime with questions. Our surety bonds experts are standing by to help. You can also visit our FAQ Page for Surety Bonds and our Blog for educational surety bond topics.