Automobile Auction Companies in the State of Indiana need to obtain a license from the state and an Indiana Automobile Auction Bond (Vehicle Merchandising Bond).

Who Needs to Be Licensed and Bonded?

Indiana Code 9-32-2-4 defines an Auto Auction Company as Automobile auction company as, ” a person whose primary business consists of arranging, managing, sponsoring, advertising, hosting, carrying out, or otherwise facilitating the auction of more than three (3) motor vehicles or watercraft on the basis of bids by persons acting for themselves or others, within a twelve (12) month period. The term includes a place of business or facilities provided by an auctioneer as part of the business of the auctioneer for the purchase and sale of motor vehicles or watercraft on the basis of bids by persons acting for themselves or others. This definition does not apply to auction companies under IC 25-6.1-1.

There are many license requirements to becoming an Automobile Auction Company in Indiana. You can read more about those requirements here.

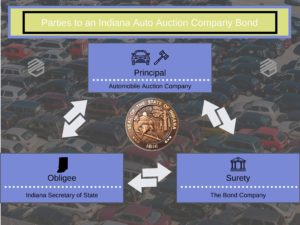

Who Are the Parties to an Indiana Vehicle Merchandising Bond for Auto Auction Companies?

These surety bonds are a three-party guarantee. The Automotive Auction Company is the Principal on the bond. The Obligee is the party requiring the bond and who gets the direct benefit of the guarantee. On this bond, the Obligee is The Indiana Secretary of State Auto Vehicle Services Division. The Surety is the bond company who is guaranteeing the obligation of the bond.

What Does the Indiana Auto Auction Bond Guarantee?

The surety bond guarantees that the Auto Auction Company will comply with all laws, ordinances and resolutions that govern the issuance of the License issued by the Indiana Secretary of State. You can read more about these responsibilities here. A person may file a claim against the Auto Auction Company for violating the provisions. The State requires that notice be given, an opportunity for a hearing and an opportunity for judicial review. The bond secures damages for a person who is affected by a violation of the auction company after a judgement has been issued. The bond also helps secure payment of fines, penalties, costs, and fees assessed by the Secretary of State.

Amount of the Indiana Vehicle Merchandising Bond for Auto Auction Companies

The State of Indiana requires that Automobile Auction Companies maintain a surety bond in the amount of $25,000.

How to Obtain an Indiana Auto Auction Company Bond

These bonds are very easy to obtain and can be purchased instantly below by most auto auction companies. Most surety bond companies do require a credit check for these bonds. MG Surety works with 25+ bond companies and can help auctioneers of all circumstances. We even have options for those with credit challenges.

What is the Cost of an Indiana Auto Auction Company Bond?

Many surety bond companies charge 1% or $250 per year for these bonds. We do work with bonds companies with even better pricing, but you must call and qualify for preferred pricing.

Length of the Bond

The Indiana Vehicle Merchandising Bond is continuous for as long as the Auto Auction Company is licensed. That means the bond will need to be renewed each year. That also means that the bond premium will be due each year that the bond is in force.

Cancellation of the Bond

The Surety may cancel the bond by giving thirty days written notice to the Obligee and the Principal. The notice of termination does not become effective until the Secretary of State receives the notice at their office which is currently:

302 West Washington Street

Room E-111

Indianapolis, IN 46204

The Surety is still liable for actions violations committed while the bond was in existence and during the thirty-day notice period. If the Surety cancels the bond for any reason, the Auction Company will need to secure a replacement bond from another surety bond company or risk having their license suspended.

Indemnity is Required

Like most surety bonds, Indiana Auto Auction Company Bonds require indemnity. These bonds are not insurance and the surety bond company will seek reimbursement from the Auto Auction Company and any other indemnitors if they must pay a valid loss. You can read more about indemnity here. Claims against these bonds should be avoided.

Indiana Automobile Auction Bonds are required by the State. Fortunately, these surety bonds are easily obtainable for most Automobile Auction Companies and can be purchased instantly. Auctioneers may also need other Indiana Surety Bonds. Many of those can also be purchased directly here. Contact MG Surety Bonds anytime with questions. Our surety bonds experts are standing by to help. You can also visit our FAQ Page for Surety Bonds and our Blog for educational surety bond topics.