Personal Protective Equipment or PPE is in high demand. Many public and private entities are placing large orders for supply of PPE and are asking the suppliers to provide Bid Bonds, Performance Bonds or Supply Bonds guaranteeing the delivery of these products. Unfortunately, many manufacturers of PPE products have never been asked for surety bonds before and do not know what they are, or how to obtain one. Below are some of the risks of these surety bonds and some considerations to make them easier.

What is Personal Protective Equipment?

PPE is a short name for a broad category of products that protect workers or individuals from jobsite risks. However, in the current climate of COVID-19, PPE contracts are often for the supply or manufacturing of masks, gloves, and medical gowns to prevent the spread of the virus.

Parties to a PPE Surety Bond

Regardless of whether a bid bond, supply bond or performance bond is being required, the parties to a PPE Bond would be the same. The Principal on the bond would be the company who is supplying or manufacturing the PPE products. The Obligee is the entity who is requiring the surety bond and who receives the benefit of the bond. The Surety is the bond company guaranteeing the obligation.

Underwriting for PPE Bonds

Underwriting surety bonds for PPE contracts is similar to underwriting other types of surety bonds. The account needs to have the credit, character and capacity to qualify for the surety bonds. This may be a challenge for manufacturers or suppliers who have not had to qualify for surety bonding previously. Often these PPE contracts are large and required significant company net worth and working capital to qualify. This can be a challenge for a small supplier or even companies who have historically distributed most of their capital.

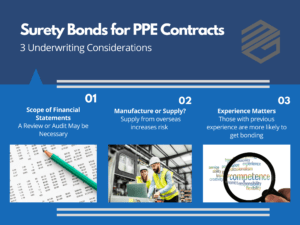

Scope of Financial Statements

Another challenge for large contracts will be scope of the financial presentation. For large contracts, surety bond underwriters often expect a CPA Review or CPA Audit of the company’s books. Manufacturers and Suppliers who are not accustomed to these requirements may find it challenging to get surety bonding. Smaller contracts of $2 million or less may be able to skip these requirements. Contracts of $500,000 or less can probably get approved with just an application and credit check.

Manufacture or Supply

A very important underwriting consideration will be whether the Principal on the bond will be manufacturing the PPE themselves or sourcing it from somewhere else. Supply chains have been disrupted around the globe and the future of that remains uncertain. Surety bond companies are currently reluctant to guarantee the supply of PPE sourced overseas. On the other hand, a U.S. based manufacturer of PPE materials will have a much easier time getting approved for a surety bond.

Experience

An important underwriting consideration will be experience producing the PPE products. Is this the manufacturer or supplier’s primary operation, or are switching from another product line to meet a spike in demand? Surety bond underwriters will be more likely to support those who have experience with the product. It will also be important to understand their material sources. Do they have readily available source material to meet the order? Will they have to rely on other material suppliers who may be operating with a reduced workforces or material shortages of their own? These details are important for surety bond underwriters to understand.

What Do PPE Performance Bonds and Supply Bonds Cost?

This depends on the financial strength of the Principal and the contract obligations. True supply only bonds can be very low cost, especially if the Principal is well qualified. On the other hand, contract obligations with more risk or Principal’s who are less qualified could pay a rate as high as 3%-4% of the bond amount. You can read more about the costs of performance bonds here.

Indemnity Required

PPE manufacturers and suppliers should understand that surety bonds are not insurance. To get these surety bonds, an indemnity agreement with the surety bond company will be required. If the surety bond company suffers a loss on the bond, they will seek reimbursement from the company and other indemnitors. Therefore, it is important to make sure your company can meet the requirements under the contract.

In the current economic climate, proving surety bonds for PPE contracts can be tricky. However, being able to provide bonding cap open opportunities for both manufacturers and suppliers. Contact MG Surety Bonds to let us help you find the best fit for your unique circumstances.