Freight broker bonds are required for most freight brokers. The Freight Motor Carrier Safety Administration (FMCSA) requires both freight forwarders and brokers who intend to be licensed under Title 49 U.S.C. 13904, a to purchase a surety bond of $75,000 before receiving thier license. These bonds are often referred to as the ICC broker bond or the BMC 84 bond. More information is available at the FMCSA website here.

What Does a Freight Broker Bond Guarantee?

The BMC-84 Bond guarantees that Freight Broker or Forwarder will pay all shippers and motor carriers that the Freight Broker or Forwarder contracts with. The specific language of the BMC-84 bond reads,

“the condition of this obligation is such that if the Principal shall pay or cause to be paid to motor carriers or shippers by motor vehicle any sum or sums for which the Principal may be held legally liable by reason of the Principal’s failure faithfully to perform, fulfill, and carry out all contracts, agreements, and arrangements made by the Principal while this bond is in effect for the supplying of transportation subject to the ICC Termination Act of 1995 under license issued to the Principal.”

By having the Freight Broker Bond, it ensures that the broker will follow the FMCSA’s rules and regulations and proptly make payments.

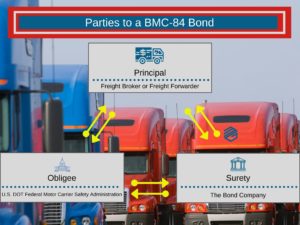

Parties to a BMC-84 Bond

The Principal on the bond is the Freight Broker or Freight Forwarder who is promising to comply with the rules and make payments. The Obligee is The United States Department of Transportation Federal Motor Carrier Safety Administration. The Surety is the bond company who is guaranteeing the Freight Broker or Freight Forwarder’s obligations.

The Actual Cost of Freight Broker Bonds

The price you pay for a freight broker bond will range depends on your personal credit and net worth. Usually, this percentage falls between one and twelve percent of the bond amount ($75,000). The stronger the financial strength and credit of a person or company, the lower the rate. Most people can expect to pay between $1,000 – $1,500 a year. However, we have rates as low as $750 per year. MG Surety works with 25+ bond companies to ensure you get the best rate for your situation.

How to Acquire a Freight Broker Bond

If you plan to start a new freight brokerage, you must register with the FMCSA to receive freight broker authority. Make sure you have a strong business plan in place before you start.

After registering, acquire the freight broker bond (BMC-84) from a surety bond company and make sure the surety bond is filed with the FMCSA. Usually this is done electronically upon approval and payment to the surety bond company. However, you can find a copy of the bond form here. MG Surety Bonds works with many companies who can provide approval based on only a credit check. You will need to provide the name, address and Federal Tax ID for the business along with the MC number. Ownership information, social security numbers and names of spouses will also be needed. A signed indemnity agreement will also be required by all bond companies. For those companies that can not qualify on credit alone, other options are available by providing:

- A completed application found here.

- A business financial statement

- A personal financial statement which can be found here.

You can purchase these BMC-84 Bonds instantly by clicking the button below and have your bond within minutes.

For the best pricing options, you can contact us. We will need this application completed.

Obtaining a BMC-84 Bond with Bad Credit

Hard times come upon us all. MG Surety Bonds can work with Freight Forwarders and Freight Brokers of all type of credit to obtain bonds. Additional underwriting items may be required in certain circumstances. Applicants in these situations should expect to payer higher rates to get bonding but we have bond companies that will work with you. In many cases, we may be able to finance the bond premium to make it easier. Keep in mind that its not forever. As you repair your credit and establish a good track record with the bond company, your rates and terms should improve as well.

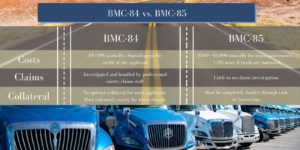

BMC 84 vs. BMC 85

You have two options to meet the set requirements to become a licensed freight broker. These include:

- Acquire a freight broker bond – the BMC-84

- Set up a trust fund – the BMC-85 (form here)

Each of these offer pros and cons depending on the needs of your specific brokerage. Many Freight Brokers and Forwarders prefer the BMC-84 because it does not usually tie up cash or credit. Most Freight Brokers and Freight Forwarders can obtain these bonds without putting up collateral such as Irrevocable Letters of Credit.

On the other hand, the BMC-85 requires that the full $75,000 be deposited in a trust. This is money that the Freight Broker or Forwarder can not use for other business purposes. The benefit may or may not be cost. However, there is still an annual mainenance cost for companies who handle these trusts so that should come under careful evaluation.

Claims Against a BMC-84 Bond

A BMC-84 (Freight Broker) Bond is not an insurance policy. These bonds are written on The Principle of Indemnity. That means that if a claim is made against the bond, the surety will investigate the claim. Generally, a Surety has 30 days to investigate the claim and either make payment, or provide a written reason for denying the claim. If the claim is found to be valid and the surety pays the claim, they can seek reimbursement from the Freight Broker or Freight Forwarder, along with any other indemnitors. This is an important differentiation and one that Freight Brokers should take seriously. Claims should be avoided at all costs. Additionally, having claims will make it very difficult and expensive to keep bonding in place. Freight Brokers and Forwarders with bad claims experience, may be forced to put up collateral in order to get BMC-84 and other bonds in the future.

Cancelling a BMC-84 Bond

Both the Principal and the Surety can cancel the Freight Broker Bond anytime by giving written notice to the Federal Motor Carrier Safety Administration. The BMC-36 Form must be completed and sent to the FMCSA’s office in Washington D.C. The cancellation is only effective 30 days after the BMC-36 form is received. Both the surety and Freight Broker or Freight Forwarder are still liable for any claims that occurred during the period that the BMC-84 Bond was in effect including the 30 day period following the receipt of the cancellation.

Work with the Professionals

There are many companies online who market these types of freight broker bonds but do not understand surety bonds. Even worse, they could be selling you a fraudlent bond and you could have to pay twice. You can learn more about verifying bonds here. Make sure you are working with a reputable surety bond broker.

At MG Surety, we are surety bond experts and we want to be your bond broker for life! Contact us today. You can also visit our FAQ on Surety Bonds page for educational resources.