Contractors in Georgia usually need a license and a Contractor License Bond to perform construction work in the state. It is the Georgia Board for Residential and General Contractors that is responsible for regulating and licensing individuals and businesses.

To acquire a Georgia Contractor License, you must pass a two-part exam that covers the license you are trying to get – one in law and one in business. It’s also necessary for you to submit your license application and to secure a contractor license bond.

To become a licensed contractor, follow the steps found here.

Meet All Requirements

To acquire a contractor’s license, you must be at least 21 years old, financially responsible, and be of good character. You must also meet one of the following criteria:

- Have a four-year degree in building construction, construction management, architecture, or a related field

- Have a combination of proven practical experience (four years) and college courses

- Have a minimum of four years of practical experience with two years as or employed by a general contractor

Choose the Type of License You Need

There are several types of contractor’s licenses in the state of Georgia and you must choose the one that’s right for the work you plan to do. These include:

- General Contractor: Unlimited contractor services as to the type of work contracted for, undertaken, and performed.

- General Contractor – Limited Tier: Provides the same work as general contractors but limited to amounts of $500,000 or under.

- Residential – Basic Contractor: Contractor work is limited to a detached one- or two-family structures and/or one-family townhouses that are no more than three stories high.

- Residential – Light Commercial Contractor: Same work as the residential-basic, with the addition of work for multi use and multifamily light commercial structures and buildings.

Once you determine the contractor license you need, you must fill out the application and pay the application fee, which is $200 and non-refundable.

There are some contractors who are exempt from these requirements. That list can be found here.

Acquire a Georgia Contractor License Bond and Insurance

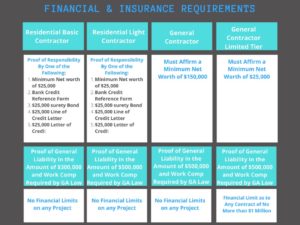

When you apply for the license, you must also provide proof of liability and workers compensation insurance. All license types are required to have $500,000 in coverage except for the Residential-Basic license, which only requires $300,000 in insurance coverage.

It’s also necessary for you to acquire a Georgia Residential and General Contractors License Bond for $25,000 or an alternative. This is a type of surety bond that provides protection for your clients if you perform subpar work or if you fail to fulfill an obligation that’s listed in your contract. You can see the chart below for a full comparison of the finance and insurance requirements:

Alternatives to Georgia Contractor License Bond

As you can see from the chart, the state will accept alternatives to a surety bond such as a letter of credit. There are reasons that contractors may not want to do this. Letters of credit often tie up valuable liquidity for contractors that could be used for their business. Surety bonds are typically unsecured credit unless a claim is filed. Additionally, surety bond company must usually investigate a claim to make sure it is valid. A letter of credit has no such duty. You can read more about the differences between surety bonds and letters of credit here.

An example of the bond is below:

Georgia Contractor License Bond Cost

The cost you will pay for these contractor license bonds varies. Usually, the premium is about 1%percent of the total required license bond amount. The cost is usually determined by the credit of the owners. Applicants with less than perfect credit can still obtain these contractor license bonds but the rate may be slightly higher. Additionally, most surety bond companies provide large discounts for purchasing multiple years up front. These discounts are usually 25%-30%.

Underwriting Georgia Contractor License Bonds

MG Surety Bonds freely writes these Georgia Contractor License Bonds. We can typically quote and issue the license bond within minutes. In fact, for the Georgia Contractor Limited Bond, Georgia General Contractor Bond, and Georgia Residential Basic Contractor Bond, we can issue those instantly without any credit check. For the Georgia Residential Light Commercial Contractor Bond, we only need to run credit. Contractor can purchase any of these license bonds instantly by clicking the button below. We work with 25+ surety bond companies and will ensure that you get the best rate for your unique situation.

Instant Purchase – Georgia Residential Light Commercial Bond

Instant Purchase – Residential Basic Contractor Bond

Instant Purchase – Georgia General Contractor Bond

Instant Purchase – Georgia Contractor Limited Bond

Verify Your Bond

As with all surety bonds, contractors should make sure they are with a reputable bond company to avoid paying for a bond twice. Your bond company should be rated “A-“ or better by the rating agency A.M. Best. You can check that here (registration required). Contractors should be very suspicious about using a bond with a lesser rating. Most contracts will also require your Surety to be listed on the U.S. Department of Treasury’s Circular 570 which you can check here. This is sometimes shorted as a “T-Listing”.

Indemnity

Contractors should do their best to make sure that no claims are file against their license bond. Surety bonds are written on the principle of indemnity and the bond company will seek reimbursement if they pay out a claim. This is a major difference between surety bonds and insurance.

Other Surety Bonds May Be Required

Contractor license bonds are a requirement of getting and maintaining a license. However, they may not be the only surety bonds that a contractor needs. Many cities and municipalities have their own license bond requirements. Many Georgia license bonds can be purchased instantly here. Additionally, contractor performing commercial work may need other construction surety bonds such as bid bonds, performance bonds and payment bonds. This can get confusing and we are happy to answer any questions that contractors may have. You can also review our Frequently Asked Questions Page about surety bonds here.

At MG Surety, we are surety bond experts and not internet marketers or insurance agents. We can provide the expertise you need to obtain a Georgia Contractor License Bond or any other surety bond that you may need. We want to be your surety bond broker for life!