Did you know that the Small Business Administration has a program for surety bonds? The program is called The Surety Bond Guarantee Program or SBG for short. The SBA itself is not a surety bond company. However, in the program the SBA will guarantee that if a surety bond company does suffer a loss, the SBA will reimburse the company for 80-90% of the loss. This financial backing encourages surety bond companies to write contract bonds for contractors that would not qualify for bonds otherwise. This can help contractors such as new and emerging companies. Let us discuss who the SBA Surety Guarantee Program can benefit and the advantages and disadvantages to this program.

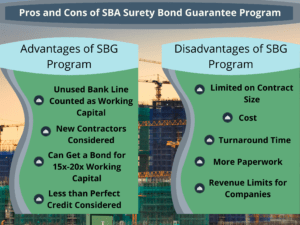

SBA Surety Bond Program Advantages:

Low Working Capital Requirements

If you have ever tried to get a contract surety bond, you know the importance of working capital (current assets – current liabilities). With few exceptions, most surety bond companies will base your bond capacity on a multiple of your working capital. Depending on your trade, it may be 10-20 times your analyzed working capital. For example, if you have $500,000 of working capital, you could potentially qualify for a $10 million bond program. Unlike standard surety bond companies, the SBA will count your unused bank line as working capital. This is one of the biggest advantages to the program. A contractor with no working capital and $100,000 of open bank line can potentially qualify for a $2 million bond. This is a big advantage over the standard surety bond market.

Another important working capital advantage is that the SBA does not count Negative Working Capital. Let us assume that you have $500,000 in current assets and $1 million in current liabilities. A standard surety bond company will look at that as $500,000 of negative working capital. They will likely not be approving any additional contract surety bonds. On the other hand, the SBA says you have zero working capital. I can’t stress what a useful tool this can be. Again, using our examples above, a contractor with $500,000 of negative working capital that has a $100,000 open bank line can still qualify for a $2 million bond. Pretty incredible!

Equity is Not Required

Equity (Assets – Liabilities) in a company is vital to have a surety bond program in the standard market. Although most surety bond companies look at working capital, all surety companies evaluate equity (or net worth). A company with negative equity is considered insolvent. Additionally, bond companies typically cannot get reinsurance for companies with negative equity and we see why most surety bond companies will not write contractors in this situation. The SBA Surety Bond Guarantee Program is different though. Decisions are made off of working capital and equity is not considered. You can see how this would be useful for an emerging contractor or one that has fallen on hard times. However, there is another type of contractor that this program is useful for and it may not be one you have considered. This is a contractor that has gone through an ownership transition.

Its a Great Surety Bond Tool for Ownership Transition

The first thing I would say is that there are many great ways to transfer ownership in a construction company that will not damage the surety relationship. One great example can be found here. Unfortunately, many surety bond brokers do not advise their customers how to do this, and by the time they realize the transition has hurt their bond relationship, it’s too late. In most circumstances it works like this: New Owner sets up a New Company and purchases the assets of the Old Company. Unfortunately, New Owner does not have enough cash to purchase the assets, so New Company takes out a loan and borrows money to pay Old Owner. If the purchase price is more than the book value, your CPA will show difference as “goodwill”. Let us show this in a real life example:

Old Company: $1 million in Book Value

Purchase Price: $2 million resulting in $1 million of Goodwill ($2 million purchase – $1 million book value).

Let us also assume the bank financed 90% of the debt. In this case, New Company’s balance sheet will show something like this:

| CPA Statement | |

| Assets | |

| Goodwill | $1,000,000 |

| Fixed Assets | $1,000,000 |

| Total Assets | $2,000,000 |

| Debt (from Purchase) | $1,800,000 |

| Equity | $200,000 |

This is perfectly acceptable if you do not need surety bonds. The problem for contractors is that bond companies do not count goodwill. It is an intangible asset and cannot be easily converted to cash to pay bills. As such, they will remove it from the analysis. In this instance they are looking at New Company’s balance sheet as such:

| CPA | Bond Company | |

| Assets | ||

| Goodwill | $1,000,000 | $0 |

| Fixed Assets | $1,000,000 | $0 |

| Total Assets | $2,000,000 | $0 |

| Debt (from Purchase) | $1,800,000 | $1,800,000 |

| Equity | $200,000 | ($1,800,000) |

As you can see, this presents a problem for standard surety bond companies. Equity is now significantly negative. Creativity would be needed to support this account in the standard surety bond market but the SBA is happy to support these accounts if working capital is sufficient.

An Option for Contractors with Less than Perfect Credit

Another benefit to the SBA bond program is that the SBA gives options to contractors who have blemishes on their credit such as a past bankruptcy or lien. These items are usually a deal killer in the standard markets. The SBA will consider these companies if the bankruptcy has been discharged or there is a payment plan in place for the lien. The SBA Surety Bond Program can also be used instead of other tools such as collateral or funds control. However, these tools are sometimes used together with the SBA Surety Bond Guarantee.

Advantages Summary:

- Unused bank line can be used as working capital

- New companies considered

- Options for contractors with negative working capital, negative equity or credit flaws

- Can obtain bond for 2 times the largest completed project

- Bond jobs 15-20 times the contractor’s working capital

SBA Bond Guarantee Program Disadvantages

Limited Single Contract Size

There are also many disadvantages to the SBA program. For starters, the largest bond that can go through the SBA program is $6.5 million on most projects and not a dollar over. $10 million is possible on some federal jobs but you must be the General Contractor. There are ways to get around this however. For example, if you need to bond an $8 million project, ask the Owner or General Contractor to break this up into two $4 million projects.

SBA Surety Bond Program is More Expensive

Another major disadvantage is the cost of the bond. In order for the SBA to guarantee the bond, they collect an additional 0.6% of the contract price on final bonds. You must pay this amount upfront with either a bank transfer or credit card. This is on top of what the surety bond company charges for the bond premium. For example, if the surety charges you a flat 1.5%, your total bond cost is 2.1%. Each bond company has different SBA rates filed though. Ask your broker if the underwriter will lower the rates to offset the SBA fee. Some will and some will not. There are typically no fees for bid bonds. You can read more about what goes into these rates here.

More Paperwork and Longer Turnaround Time

Lastly, the biggest disadvantage of the SBA Bond Guarantee Program is time and paperwork. Although they have significantly improved the process over the years, it is still more time consuming than a traditional surety program. Keep in mind that two approvals are needed. First, a bond company must give the okay. Typically they will say, “this bond is approved, pending SBA support,” or something of that nature. Once you receive that, you go to the SBA’s online system for approval. Usually this process takes a couple of days from that time the contractor submits all information. Contractors that are not familiar with government paperwork and systems may have some frustrations. The SBA will not let us submit a bond for underwriting until all information on the applications are completed. That means, contractors cannot skip boxes, guess or stop short of giving all the answers. If that happens, your broker will have to come back to you, the system will time out and start over.

Disadvantages Summary:

- Limitations on contract size

- Cost

- Additional paperwork

- Turnaround time

- Possibly limited by revenue size discussed below

Who Can Qualify?

Most contractors are surprised to learn who can qualify as a small business for this program. The SBA standards are based on average annual receipts or number of employees. This can be a disadvantage if your company does not fit the revenue requirements. A link to their size determination tool can be found here. The guidelines for construction are below:

- General building and heavy construction contractors: $33.5 million

- Special trade construction: $14 million

- Land subdivision: $7 million

- Dredging: $20 million

The SBA Bond Program is only for contractors though. This does include service contractors but it does not include Commercial Surety Bonds.

SBA Surety Bond Guarantee Quick Bond Program

The SBA also has a Quick Bond Program for contractors who have small or infrequent bond needs. This program can significantly speed up the process by requiring less paper work on smaller bonds. The bond will still need to be approved by a surety bond company before submitting to the SBA though. The SBA’s Quick Bond Application can be found here.

All of these items make the SBA a very attractive option for new or emerging contractors, contractors involved in a buy-out, contractors with credit flaws and contractors that have little or no working capital. The SBA Bond Program is a great tool but should really be thought of as a temporary situation until you can improve your company enough to get into a standard surety program.