Florida Motor Vehicle Dealer Bonds

Florida requires Motor Vehicle Dealers to be license and obtain Florida Motor Vehicle Dealer Bonds to protect the public. Section 10 (a) of Florida Statute 320.27 says,

“Annually, before any license shall be issued to a motor vehicle dealer, the applicant-dealer of new or used motor vehicles shall deliver to the department a good and sufficient surety bond or irrevocable letter of credit, executed by the applicant-dealer as principal, in the sum of $25,000.”

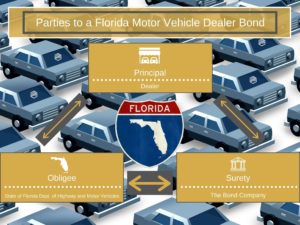

Parties to a Florida Motor Vehicle Dealer Bond

A surety bond is a three-party agreement. The Principle on the bond is the licensed dealer. The Obligee is the State of Florida Department of Highway and Motor Vehicles and the Surety is the bond company who is guaranteeing the obligation.

Purpose of a Florida Motor Vehicle Dealer Bond

The bond is meant to protect any person involved in a wholesale or retail transaction with a Dealer in connection with the sale or exchange of any motor vehicle. The bond ensures that the Dealer complies with the conditions of their written contracts and does not violate any provisions of Florida Statutes of Chapter 319 and 320. If the Dealer fails to honor their agreements or violates any part of the Florida law, a claim can be made against the Motor Vehicle Dealer Bond.

If the State of Florida determines that a person has incurred a valid loss as a result of a violation of chapter 319 or other laws, it shall notify the person in writing of the existence of the Motor Vehicle Dealer Bond.

What is the Amount of the Florida Motor Vehicle Dealer Bond?

Florida statutes require that the surety bond be $25,000. The bond is continuous and must be renewed every year that the Dealer maintains their license. However, the total bond penalty in any given year will not exceed the bond amount of $25,000.

How to Get a Florida Motor Vehicle Dealer Bond

These bonds are easily obtainable for most dealers. They can be quoted and issued instantly by MG Surety Bonds by clicking the button below. The bond is based on the credit score of the applicant and no financial statements are required.

MG Surety also works with all major bond companies to find options for almost any party. We even have programs in place for those with credit challenges. However, more information may be needed to obtain these bonds.

What is the Cost of a Florida Motor Vehicle Dealer Bond?

The cost of these bonds depends on the credit and strength of the Dealer. Most Dealers can expect to pay 1% – 2% per year. Dealers willing to submit financial statements and underwriting information can expect to get the best rates. These Dealer Bonds are continuous. Therefore, the bond premium will be due every year that the bond is in place.

Who is Required to Obtain a Florida Motor Vehicle Dealer License Bond?

Florida defines Motor Vehicle Dealers as,

“any person engaged in the business of buying, selling, or dealing in motor vehicles or offering or displaying motor vehicles for sale at wholesale or retail, or who may service and repair motor vehicles pursuant to an agreement as defined in s. 320.60 (1). Any person who buys, sells, or deals in three or more motor vehicles in any 12-month period or who offers or displays for sale three or more motor vehicles in any 12-month period shall be prima facie presumed to be engaged in such business.”

Those that fall within this category, likely need a license and a Motor Vehicle Dealer Bond with some exceptions. These include businesses disposing of vehicles used for operating purposes, moped, motorcycles and Mobile Home Dealers. However, these parties have their own separate bond requirements with the state.

Indemnity Required

Like all surety bonds, Florida Motor Vehicle Dealer Bonds require indemnity of the Dealer. That means that if the bond company suffers a loss, they will seek reimbursement from the Dealer and any other indemnitors. Dealers can read more about indemnity here, but losses should be avoided at all costs.

Other Bond Requirements

The Florida Motor Vehicle Dealer Bond must be issued by Surety who is licensed to do business in the state of Florida. Further, we would encourage all Dealers to check the financial rating of the Surety Bond Company. At a minimum, it should be rated “A-“ or better by a rating company such as A.M. Best. You can learn more about Verifying Surety Bonds and protecting against surety fraud here.

Bond Cancellation

Florida Motor Vehicle Bonds can be cancelled by the Surety by giving the State 30 days written notice by certified mail. The Dealer must then either replace the bond with another bond or risk having their license suspended.

Alternatives to a Florida Motor Vehicle Dealer Bond

Florida allows a Dealer to post an Irrevocable Letter of Credit instead of a surety bond. However, a surety bond may be a better alternative as it does not decrease the Dealer’s borrowing ability. Further, the surety bond company is required to investigate a surety claim before paying out on the bond. No such requirement exists with an Irrevocable Letter of Credit. You can learn more about advantages and disadvantages of surety bonds against letters of credit here.

Florida Motor Vehicle Dealer Bonds are a requirement for Dealers in Florida. These bonds are easily obtainable and can be purchase instantly in a matter of minutes. However, our surety bond experts are always available to assist and answer questions. Contact us anytime. Motor Vehicles Dealers in Florida may also need other types of bonds and many of those can be purchased instantly here. You can also learn more about surety bonds by visiting our FAQ Page on Surety Bonds and by visiting our Blog for surety bond related educational material.