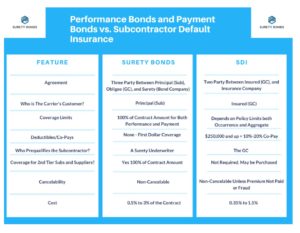

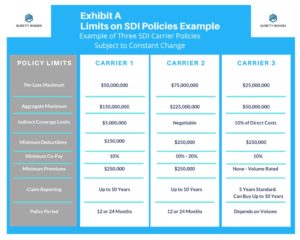

We often get asked about subcontractor default insurance (SDI) and how it compares to surety bonding. Some people just call it “Subguard”. Subguard is Zurich’s proprietary product that was first introduced to the market, and that many contractors are familiar with that term. However, many insurance companies have entered this product field over the years. SDI is a growing product and can be a valuable way for contractors to protect themselves. However, it may not be right or affordable for all contractors. It’s important for contractors to know what it is and how it may or may not provide the protection they are looking for. Because SDI is an insurance policy, each carrier will have its own policy languages, deductibles, etc. We will speak in general terms with the information available at the time of this writing. You can see examples of limits and deductibles for three SDI carriers in Exhibit A at the end of this article. We will also compare subcontractor default insurance against performance and payments bonds. First let’s take a quick look at the chart below:

Surety or Insurance

The first difference you will notice is the agreement. Surety bonds are a three-party guarantee and more likely resembles credit than insurance. The subcontractor is the surety bond company’s customer, not the General Contractor. This is an important distinction. The surety bond underwriter must therefore be responsible for prequalifying the contractor. Surety bonds are written on the assumption of “no losses”. That means the underwriter assumes they are qualified both from a financial and capability standpoint before they will issue the bonds. It also means that the General Contractor incurs no deductible or loss. Should a valid claim occur, the surety will have to remedy the situation and seek reimbursement from their contractor through the indemnity agreement. In other words, the surety bond company bears all the direct costs in a claim, but not all the indirect cost which we will discuss later. You can also read more about performance bond claims here.

Unlike surety bonds, SDI is an insurance product (it is in the name after all). That is not a bad thing but it does change the relationship. As an insurance product, it’s a two-party agreement between the general contractor and the insurance company. Like most other insurance products for contractors, the general contractor shares in the risk through deductibles and Co-Pays. As of this writing, most deductibles are $250,000 or greater, but again this depends on the carrier (see Exhibit A at end of the article). This also makes the general contractor directly involved in prequalifying their subcontractors as a measure of loss control. This is an expensive step as the general contractor will either need to keep qualified professionals on staff or outsource this to a third party.

Another important distinction we see in our chart is that Subcontractor Default Insurance may or may not provide coverage for 2nd tier subcontractors and suppliers. In other words, if the subcontractor’s sub or supplier makes a claim, there may not be coverage under an SDI policy. Contractors using SDI would be wise to purchase this coverage if it is available from the carrier.

We also see cancelability provisions. Contract surety bonds cannot be canceled once written. Therefore, the obligee is assured that protection is in place throughout the project. in most cases, SDI cannot be canceled either. However, there are a couple of tricky caveats in to this rule of thumb. For example, non-payment of premium may be a reason for policy cancellation. As someone who has suffered loss from a contractor not paying their insurance premium, I can tell you it does happen and it is not fun.

Now if you stop reading here, you may assume this is another one-sided article bashing SDI and that is not the case. There is a reason that SDI is a growing product and replacing surety bonds in many cases. The biggest reason is the claims process. One obligation of surety bonds is the responsibility to investigate claims before paying them. Since, the surety bond company is entitled to reimbursement, this protects the Principal on a surety bond from paying a frivolous claim. Unfortunately, many surety bond forms use the phrase, “reasonable time.” The reality is that this can often be a long, time-consuming process. Surety bond companies often must send out consultants to go through the contract, paperwork and project information. “Reasonable” can be a few weeks or months. This can create significant delays for the general contractor and project owners, especially if the subcontractor was a critical path sub. It can also increase indirect costs such as holding up other trades, additional overhead, delay damages, etc.

Some innovative surety bond companies have come out with surety bond forms to speed up the process, such as giving only 30 days to investigate the claim and respond and respond.

On the flip side, SDI generally makes the claims process faster for the general contractor and why many of them like the product. The general contractor must only default the subcontractor under a valid policy condition to make a claim and receive payment from the insurance carrier. This payment typically must be made within 30 days and the project can continue. This can be a significant and valuable benefit to the general contractor and Owner. There is also some opportunity for cost savings if the claims experience meets certain criteria. general contractors can qualify for returned premiums with most carriers.

Subcontractor Default Insurance Only Protects the General Contractor

Subcontractor default insurance does have some flaws as well. First, it is not acceptable on projects with public money involved. The reason is that SDI only benefits the general contractor and not the project owner. If the general contractor gets in trouble, there is no protection to the owner against mechanics liens. For this reason, it is not allowed on Miller Act projects. Keep in mind that the general contractor can put up their own performance and payment bonds to the project owner and then use SDI as a measure of protecting themselves.

On private projects, if the general contractor does not put up a payment bond, there is no protection for the Subcontractors and Suppliers on the project. Again, SDI protects the general contractor. Subcontractors and suppliers performing work for an unbonded GC should consider that payment risk and factor that into their bids.

Claims Activity and the Current Market Conditions

Another consideration is claims activity and how that will affect the future of both industries. Surety bond carriers generally make money when they keep losses below 40%. The industry is well below that currently and the market continues to be very “soft.” You can read more about the current surety bond market here. The property and casualty insurance industry has been “soft” also, but SDI is one of the few exceptions. Losses regularly exceed 100%, which has driven up deductibles and led to tougher conditions. Reasons for high loss experience include the following:

- General Contractors are responsible for prequalifying contractors and those standards vary

- General Contractors are awarding contracts to subcontractors with substantially lower prices than other bidders

- General Contractors are increasingly putting high-risk subcontractor trades such as “glaziers” into SDI

- There is an incentive to overload subcontractors by repeatedly using the same ones. This saves on prequal expenses and deductibles.

The entrance of new insurance carriers into Subcontractor Default Insurance has helped keep costs down. Their experience in the market bears watching as that will determine the pricing and viability of the product for many contractors in the future.

Because of the “soft” surety bond market, we are seeing other trends that benefit the SDI market. One of these is adverse selection. To keep losses in their SDI program minimal, General Contractors are routinely asking for performance bonds and payment bonds from subcontractors considered “high risk” from a financial standpoint. These surety bonds are usually easily obtainable under current market conditions. However, if we see a “hardening” of the surety bond market, general contractors may be incentivized to put these into SDI and risk further losses.

Another current issue for the surety bond industry is the free prequalification of subcontractors for SDI. Underwriting and prequalifying is expensive. We are seeing some general contractors use the surety industry for this process. Most brokers and surety bond companies do not charge for bid bonds even though a contractor must go through underwriting to get one. As a result, some general contractors are asking subcontractors for a bid bond and if they can obtain one, put them into SDI assuming they are a good risk. Should this practice continue to grow, some surety bond companies may decide to start charging for these bid bonds and shift the costs back to the general contractor.

Wrapping It All Up

We believe both surety bonds and subcontractor default insurance can serve a purpose and we do not believe either product is going anywhere. We really think is important for contractors and owners protect themselves, their projects and their balance sheets. Both products are better than using nothing at all. Also, where you stand depends on your circumstances. Large general contractors that can absorb the deductibles and premium should consider SDI. Smaller contractors likely cannot afford the risk and should require their subcontractors and suppliers to provide performance bonds, payment bonds and even supply bonds. On many projects, it makes sense to use both surety bonds and SDI. In these instances, the general contractor provides construction bonds to the Owner and uses SDI to protect themselves from Subcontractor default. At MG Surety Bonds, we are surety bond experts and want to help you protect your balance sheet so we can maximize your surety bond capacity. We are always standing by to provide you with the best advice for any situation. Contact us today.